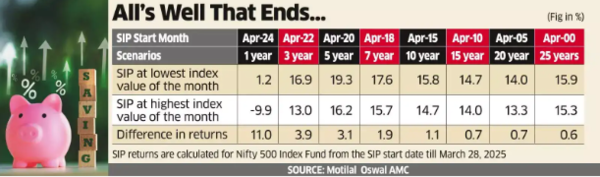

Are you planning to start investing in SIPs but worried that market ups and downs might hurt your returns? Many investors get caught up trying to time their systematic investment plan (SIP) contributions to coincide with the market’s monthly lows. But a recent study by Motilal Oswal Asset Management suggests this effort may be largely pointless.The study found that over longer periods, the difference in returns, whether you invest at the highest or lowest point of the month, is negligible. For instance, in monthly SIPs made in the Nifty 500 index over a 10-year period, the return gap between someone who invested at the market’s peak each month and another who managed to hit the bottom was just 1.13%.“The probability of being lucky and consistently investing at the lowest index value each month is mathematically close to zero,” said Pratik Oswal, head of passives at Motilal Oswal AMC.Over a 10-year SIP, investors who consistently caught the monthly lows earned 15.82%, while those investing at the highs earned 14.68%, ET cited the Motilal Oswal AMC report.

Though the margin is slightly more pronounced in the short term, the advantage fades with time. In a one-year SIP starting April 2024, for example, someone who hit the lowest point each month earned 1.17%. Meanwhile, an investor who unknowingly bought at the highest point every month saw a 9.9% loss, a stark 11.04% difference.“SIPs should go through atleast one market cycle of 5-7 years,” said Amol Joshi, founder of Plan Rupee, was quoted as saying.By the five-year mark, the return gap drops to just 3.08%. Over 15, 20, and 25 years, the difference narrows even further to 0.73%, 0.71%, and 0.59%, respectively.Wealth advisors agree that investors are better off focusing on consistency rather than precision. “Time in the market is important as it is impossible for retail investors to time the markets,” said Viral Bhatt, founder of Money Mantra.