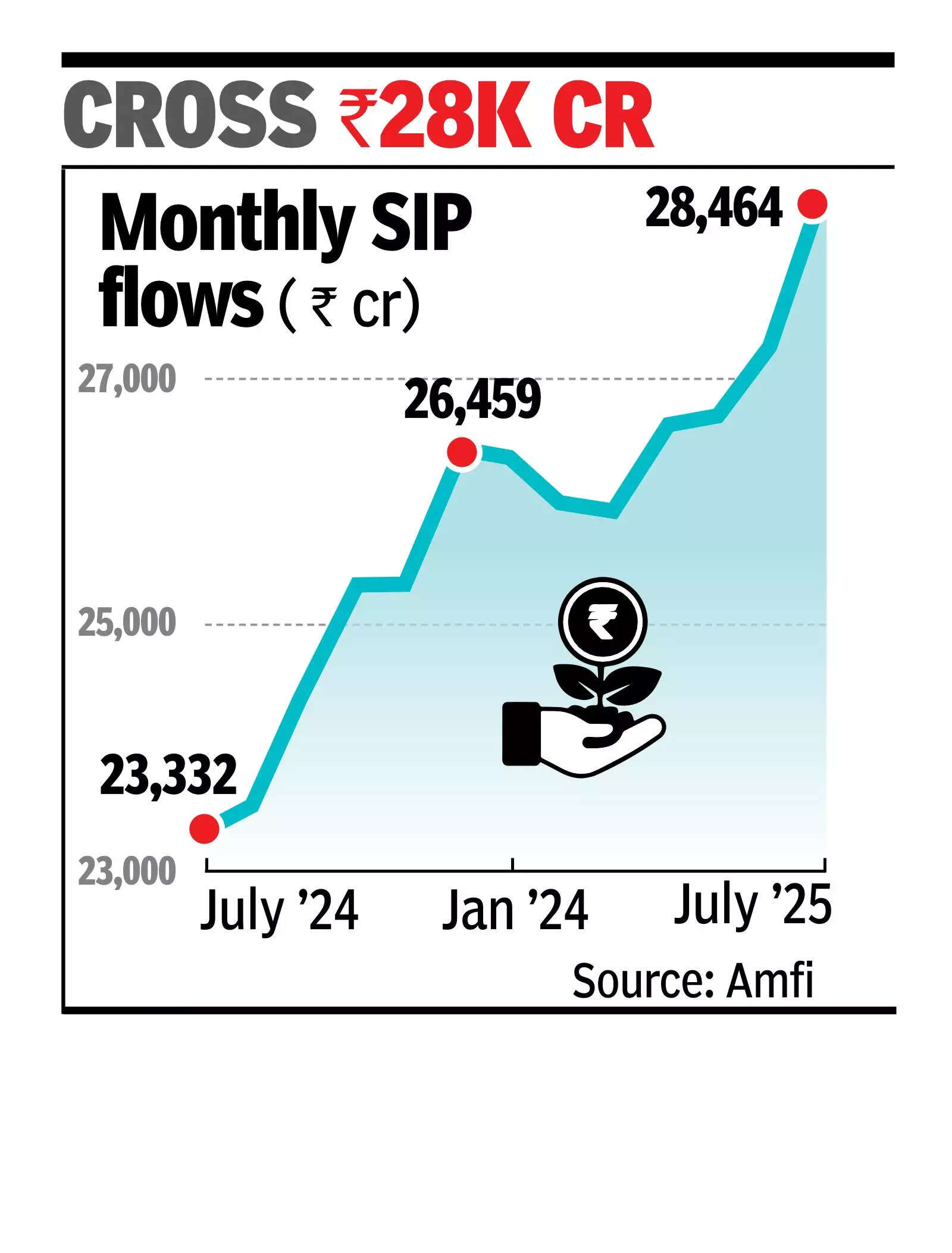

MUMBAI: Investors ignored a volatile stock market in July and doubled down with their investments in mutual funds during the month – mostly through equity schemes – surpassing several records. Monthly gross flows through the SIP route, monthly net equity flows and total assets managed by the fund industry, all recorded new peaks in July.At the end of July, gross SIP flows crossed the Rs 28K crore mark for the first time to Rs 28,464 crore, monthly equity flows crossed the Rs 42K crore mark to Rs 42,702 crore while the industry AUM crossed the Rs 75-lakh-crore mark to settle at nearly Rs 75.4 lakh crore, data released by industry body Amfi showed.

Total industry assets scaled a new high despite pressures from a strong dollar and persistent foreign fund outflows. “This is a testament to sustained investor confidence and disciplined participation,” Amfi chief Venkat N Chalasani said. Equity funds recorded their highest-ever monthly inflows and domestic funds maintained strong support to the market, he said. And SIP contributions hitting a new record high with the contributing SIP accounts growing 5.4% to 9.1 crore, were clear evidence of disciplined investing even amid volatility, he said.This was the 53rd consecutive month of net inflows through equity mutual funds. According to Aditya Birla Sun Life MF’s MD & CEO A Balasubramanian, the record inflow into equities and all-time high SIP contribution reflect the deep commitment and trust shown by the investors in mutual funds.