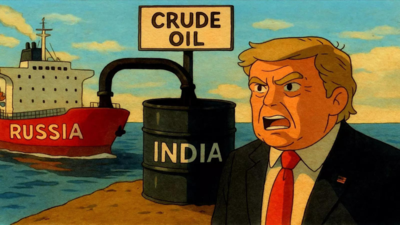

India’s purchases of Russian crude oil have risen to 2 million barrels per day (bpd) in August, up from 1.6 million bpd in July, according to data from global analytics provider Kpler. The increase, which came at the expense of imports from Iraq and Saudi Arabia, means Russia supplied 38 per cent of India’s estimated 5.2 million bpd crude imports in the first half of August.Kpler data showed Iraq’s supplies to India fell to 730,000 bpd from 907,000 bpd in July, while Saudi Arabia’s dropped to 526,000 bpd from 700,000 bpd, PTI reported. The US was the fifth-largest supplier at 264,000 bpd.“Russian crude imports into India have so far remained resilient in August, even after the Trump administration’s tariff announcement in late July 2025,” said Sumit Ritolia, Lead Research Analyst (Refining & Modeling) at Kpler. He noted that August cargoes were booked in June and early July, well before any policy shifts, and real adjustments would only be visible from late September.IOC Chairman Arvinder Singh Sahney said there had been no government directive to reduce purchases from Russia after President Donald Trump imposed an additional 25 per cent tariff on US imports from India. “Neither we are being told to buy nor told not to buy,” he said. “We are not making extra effort to either increase or decrease the share of Russian crude.” Russian oil made up 22 per cent of IOC’s crude in April–June and is expected to remain at similar levels.BPCL Director (Finance) Vetsa Ramakrishna Gupta told investors Russian imports had eased last month as discounts narrowed to $1.5 per barrel, adding the firm aimed to keep Russian crude at 30–35 per cent of its procurement for the rest of the year. Discounts this month have widened slightly to over $2 per barrel.Before the Ukraine war in February 2022, Russian oil was less than 0.2 per cent of India’s imports, but now accounts for 35–40 per cent. Ritolia said refiners were exploring more barrels from the US, West Africa, and Latin America to hedge against disruption risks, though this was “added flexibility, not a deliberate pivot”.Sahney stressed that crude oil imports from Russia were never sanctioned. “Such purchases will continue unless sanctions are imposed,” he said, adding economic considerations would remain the guiding factor. “Neither are we being told to buy more nor are we told to buy less from US or any other destination.”