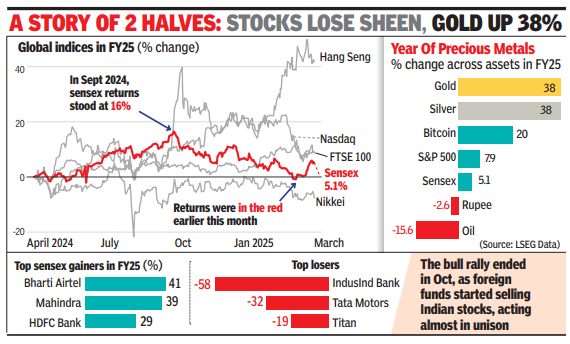

During the first half, till Sept, the sensex and Nifty were sprinting away and it looked difficult to stop them. But the sudden end to the rally began in Oct, as foreign funds started pulling out money from Indian stocks, acting almost in unison. As they continued to sell, red marks started appearing in portfolios and mutual fund holdings of domestic investors.

In H1 FY25, the sensex notched up a gain of around 16% while the story reversed dramatically in H2 when it recorded losses of 8.9%. On an annual basis, the sensex gained a modest 5.1%.

Congratulations!

You have successfully cast your vote

As a result of the slide during H2 FY25, investor wealth, measured by BSE’s market cap that had shot up by over Rs 94 lakh crore in H1 FY25, slid by about Rs 63.7 lakh crore, leaving a net addition of Rs 30.4 lakh crore by the close of the year. FY25 also saw a record Rs 3.8 lakh crore being raised from the equity market and another Rs 11.1 lakh crore from the debt market, also a new record.

The year will probably be remembered for the outperformance of gold and silver. In the domestic market, the prices of both the precious metals rallied 38% each while in the international market silver with a 43% gain outperformed gold’s 40%. On Friday, gold in the local market traded at above Rs 91,000/10gm while silver crossed the Rs 1 lakh/kg mark.

FY25 also saw strong selling by foreign funds in stocks with the annual net outflow figure at nearly Rs 1.3 lakh crore, NSDL data showed. In contrast, mutual funds were net buyers of stocks worth Rs 4.6 lakh crore, official data showed. The year also saw a record amount of gross inflows into mutual funds through the SIP route. Compared to Rs 2 lakh crore in FY24, in 11 months of FY25, SIP inflows were at Rs 2.6 lakh crore, industry data showed.