MUMBAI: In a setback to Subhash Chandra and his family, shareholders of Zee Entertainment Enterprises rejected a Rs 2,237-crore capital infusion proposal, thwarting the founding clan’s attempt to increase ownership to 18% from 4% in the broadcaster. The development restricts the family from wielding greater influence over the company where public shareholders have repeatedly defeated key management resolutions. The special resolution failed to secure the required 75% shareholder approval, with the company managing to obtain 60% votes in favour of issuing convertible warrants worth Rs 2,237 crore to its promoters.

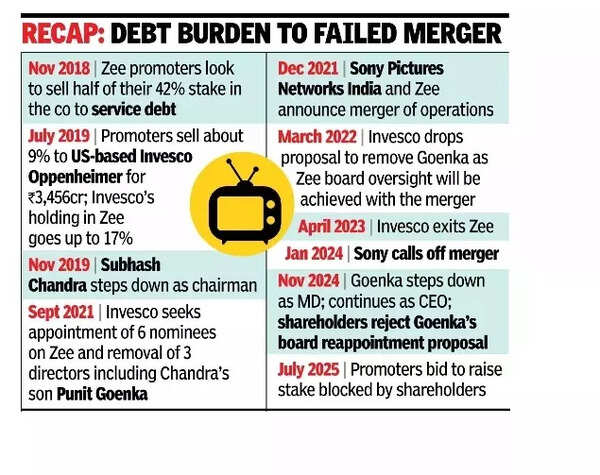

“The board and the management respect the decision taken by the remaining shareholders,” said Zee, acknowledging the 40% who opposed the resolution. The outcome demonstrates the growing influence of shareholder activism in India, where institutional and individual investors express their views on corporate matters, including executive compensation, board appointments, and related-party transactions. In 2014, Tata Motors’ minority shareholders, in a surprising move, rejected a proposal for increased compensation for its then MD.Zee said based on the voting results, the special resolution failed to secure shareholder approval as the votes cast in favour did not exceed three times the number of votes cast against. Therefore, it was not passed with the required majority, the company said. The development comes after Zee shareholders rejected CEO and Chandra’s son Punit Goenka’s board reappointment in Nov 2024. About 50% of shareholders opposed retaining Goenka as a director on the company’s board. Currently, the Chandra family has no seat on the board of the media company, which they founded in 1982.“The rejection would have stemmed from the fact that the proxy shareholders were not getting an equitable deal. A rights issue or a QIP is seen as more equitable since all the existing shareholders or new shareholders can participate in the same,” said Nitin Menon, managing partner, NV Capital, an entertainment sector-focused private credit fund. “The shareholders probably felt that convertible warrants were not in their favour. Though one cannot ignore that 60% of the shareholders were favourable towards the convertible warrants deal, institutional shareholders through their proxy would have not been in favour,” Menon added. Ahead of the voting, several advisory firms recommended voting against Zee’s fund-raising proposal, which was advised by investment bank JP Morgan. They pointed out that Zee has robust liquidity with over Rs 2,400 crore in cash and investments.