MUMBAI: Tariff-related developments, the direction in which prices of US government bonds move, trading pattern of foreign funds, and corporate results for the Jan-March quarter will decide investor behaviour on Dalal Street in the truncated three-day trading week starting Tuesday. Market players, however, warned that volatility is expected to continue even though there seems to be some thaw in the US-led tariff war, especially with China, its biggest trading partner.

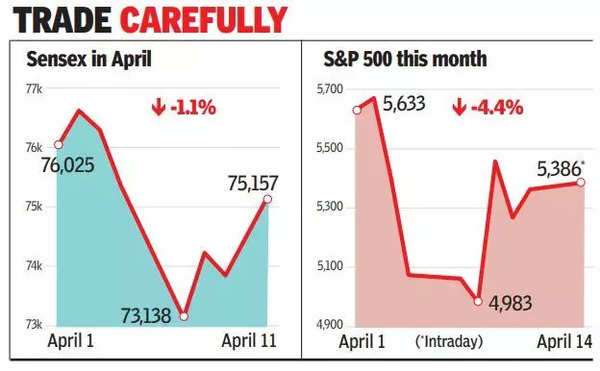

The trading week of April 7 was equally volatile. Following global markets, the sensex and Nifty saw wild swings as US President Donald Trump first hiked tariffs on most of America’s trading partners, then kept changing several parameters without warning, and China retaliated. At close, sensex was at 75,157 points while Nifty closed at 22,829 points.

On Monday, the US markets opened sharply higher and were holding on to the levels in early trades. Nasdaq Composite was up 1.9%, S& was up 1.6% while Dow Jones index was up 1.3%. If they hold on to those levels till close of the session, that will have a positive impact on Indian markets’ opening trades on Tuesday, domestic market players said.

“The after effects of tariffs seem to be subsidizing until new bombs explode,” said Arun Kejriwal, director, KRIS, an investment advisory firm. Investors should expect markets to remain volatile this week, he said. “It appears the fall in Nifty to 21,743 points is more or less a bottom for the time being. The rebound (last week) was swift on expected lines. Markets would look for directions on the tariff front in the 90-day window set by Trump.”

Markets will also watch out for how foreign fund managers trade in the Indian market. So far in April, foreign portfolio investors (FPIs) have net sold stocks worth about Rs 27,000 crore. Although domestic funds have been cushioning FPI selling, offloading of stocks by foreign funds has been pulling markets down since Sept 2024. This also has been weakening the rupee.

Market players will also look at results from India Inc. Home-grown tech leaders Infosys and Wipro are set to announce their quarterly and FY25 results later this week. The two private sector baking majors- HDFC Bank and ICICI Bank-have also scheduled their results on April 19. After TCS’s results on Friday that failed to enthuse analysts and investors, the ones from blue chip companies will be watched more closely, market players said.

Investors are also closely watching price trends in the commodities markets. In a major development, Goldman Sachs raised its year-end target price for gold to $3,700/ounce, from $3,300 earlier.