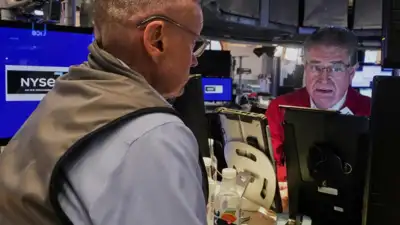

US stock markets hovered near record highs on Tuesday as investors weighed mixed earnings and trade policy signals, with General Motors flagging a $4–5 billion tariff hit for 2025, while homebuilders surged on better-than-expected second-quarter profits.The S&P 500 was little changed after reaching a fresh record on Monday. The Dow Jones Industrial Average rose 27 points (0.1%), while the Nasdaq composite slipped 0.1% after hitting its own all-time high, AP reported.Shares of General Motors fell 5.2%, even as the company reported stronger-than-expected quarterly earnings. GM reiterated that it expects tariffs to impact its full-year results by as much as $5 billion and warned that the third quarter will feel the tariff strain more sharply than the spring quarter. The automaker also said it hopes to mitigate 30% of the total impact through cost adjustments.The GM warning comes ahead of an August 1 deadline for US trade negotiations, with many of President Donald Trump’s proposed tariffs still on hold as discussions continue with major trade partners. Trump has pushed for new auto-related tariffs and pressured the Federal Reserve to accelerate rate cuts.Homebuilders offered a bright spot in the day’s trade. D.R. Horton surged 10.2% and PulteGroup rose 7.7% after both companies posted stronger-than-expected spring quarter profits. However, both cited continued challenges in the housing market due to high mortgage rates and economic uncertainty.Elsewhere, Genuine Parts Co. rose 2.5% after topping Wall Street’s profit estimates, though it trimmed its full-year guidance to reflect the impact of existing US tariffs and a weaker business outlook for the second half.Coca-Cola fell 1.6% despite reporting better-than-expected profit. While price hikes helped offset volume declines, revenue only marginally beat expectations. Coke’s global case volumes dropped 1% in Q2.In the bond market, Treasury yields remained stable, with the 10-year yield easing to 4.36% from 4.38% on Monday. Investors continue to expect the Fed to resume rate cuts in September, with Chair Jerome Powell signalling a data-dependent approach amid the inflation impact of Trump’s trade policies.Global markets were mixed. Japan’s Nikkei 225 fell 0.1% after an early surge post-holiday. Political uncertainty deepened after Prime Minister Shigeru Ishiba’s coalition lost its upper house majority, with analysts saying a breakthrough in US-Japan trade talks could be key to regaining momentum. Other major Asian and European indexes showed modest declines.