MUMBAI: RBI governor Sanjay Malhotra on Friday flagged the need for a sustainable financial model to support the rapid growth of UPI and ensure long-term viability of the digital payments infrastructure.“About two years ago, the number of UPI transactions was about 31 crore per day. In two years it has doubled to more than 60 crore a day,” Malhotra said, adding that the rising volumes make it essential to cover operational expenses. “Costs will have to be paid, someone will have to bear the cost. It is an important infrastructure,” he said, while speaking at an event organised by Financial Express.“Right now, it is govt which is defraying those costs. Going forward, how those costs are handled is very important. Whatever needs to be done, we will ensure that we have a good, robust, secure, accessible payment system working in our country.”

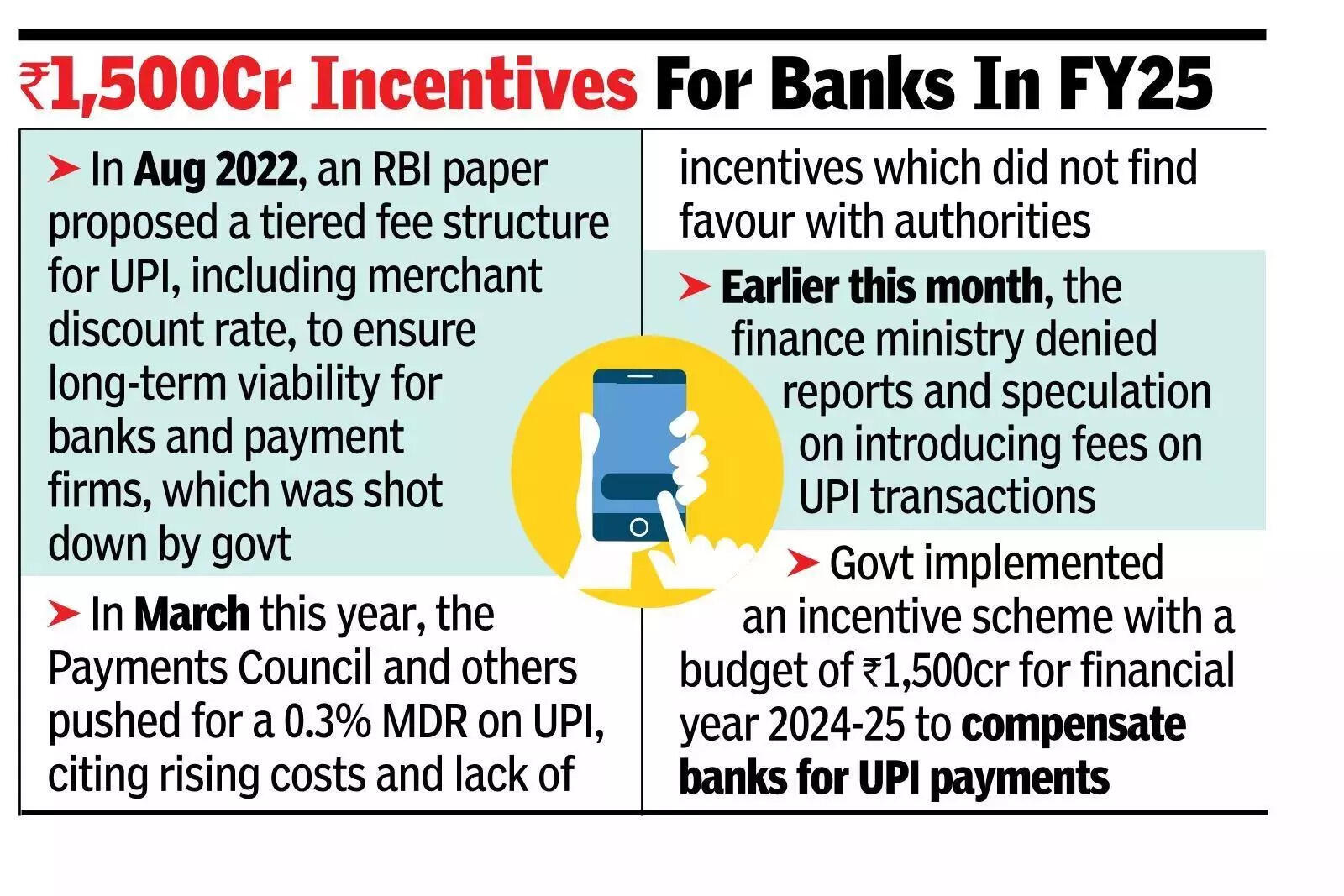

He said govt’s decision to subsidise UPI transactions had helped boost adoption. “Govt has taken a view that it should be available free and govt is subsidising it. And I would say that it has borne good fruits,” Malhotra said.The RBI governor’s comments come amid industry demands to reinstate the merchant discount rate (MDR) on UPI payments – especially for high-value transactions or large merchants. The MDR was set to zero from Jan 1, 2020, to promote digital payments, but banks and fintechs argue that the zero-charge regime is no longer sustainable due to rising tech and infra costs.While payment players have lobbied for a modest MDR on bigger transactions, govt has repeatedly ruled out any direct levy on users or merchants, calling UPI a “digital public good”. Instead, it has offered incentives to ecosystem players. Public sentiment has also been strongly against charges – surveys show that most users would reduce or entirely stop using UPI if transaction fees were introduced.