NEW DELHI: Finance minister Nirmala Sitharaman on Tuesday said the Budget has provided “unprecedented tax relief to honest taxpayers” and is aimed at boosting domestic production and enhancing export competitiveness, while indicating that the Income Tax Bill to replace the 63-year-old law will be taken up for discussion during the monsoon session of Parliament.

In Budget, FM had proposed a relief of up to Rs 1.1 lakh for taxpayers, hoping that more money in hands of people will spur demand.

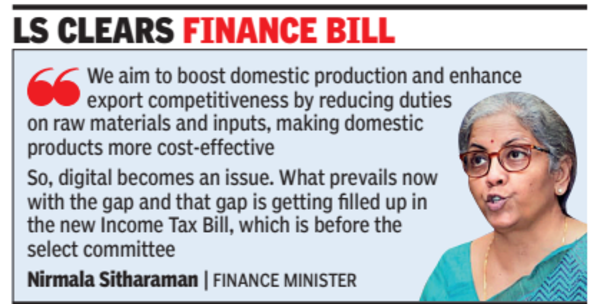

On Tuesday, the Lok Sabha passed the Finance Bill 2025 incorporating 35 amendments. In her reply to the discussion on the Bill, Sitharaman highlighted the changes in customs duties. “We aim to boost domestic production and enhance export competitiveness by reducing duties on raw materials and inputs, making domestic products more cost-effective,” she said. She also sought to address some concerns over power to access digital records proposed in the I-T Bill, said the records will also be taken into account. The current law permits the examination of books of account, physically kept or every manual record, which shows income expenditure.

Since the 1961 Act does not mention the digital records, most often it becomes contentious and people go to the court and seek protection from not sharing passcode, she said. “So, digital becomes an issue. What prevails now with the gap and that gap is getting filled up in the new Income Tax Bill, which is before the select committee,” she said.

The new Bill gives tax officers powers to override the access code of computer systems and virtual digital space, including online trading and investment accounts as well as cloud servers, in search and seizure cases.

Now, the Budget will be taken up for discussion by the Rajya Sabha.