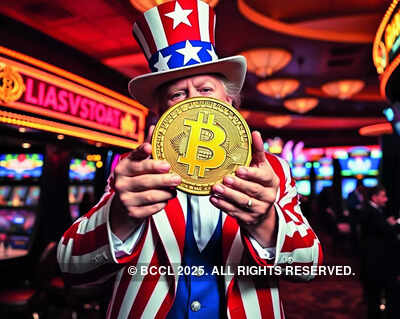

Donald Trump is making his crypto love official. On Friday, the US President hosted top players from the cryptocurrency world at the White House, signaling a major policy shift in favor of digital assets—while also raising conflict-of-interest questions given his deep financial ties to the sector.

From skepticism to embrace

Trump’s administration is actively working to “end the war on crypto,” as his newly appointed “crypto czar,” Silicon Valley investor David Sacks, put it before stepping into the meeting. With major crypto investors bankrolling his campaign, Trump is delivering on promises to legitimize the industry—unlike his predecessor, Joe Biden, whose administration maintained a hardline stance.

Sacks gathered a powerhouse group of industry titans, including Cameron and Tyler Winklevoss (Gemini), Brian Armstrong (Coinbase), and Michael Saylor (MicroStrategy), to discuss policies that could propel digital assets forward. The meeting also followed Trump’s signing of an executive order establishing a “Strategic Bitcoin Reserve“—a bold move aimed at solidifying crypto’s role in the US financial system.

Trump’s personal crypto ties

The embrace of digital currency isn’t just policy—it’s personal. Trump launched his own “Trump” memecoin in January, and First Lady Melania Trump followed up with $MELANIA right before the inauguration. He’s also partnered with exchange platform World Liberty Financial, further intertwining his administration with the crypto world.

A divisive policy shift

Supporters see Trump’s crypto-friendly stance as a long-overdue move to free the industry from regulatory shackles. Critics, however, warn of speculative risks and potential market instability. While Sacks insisted that the administration’s actions don’t amount to investment advice, he also acknowledged crypto’s volatility: “My job is to create an innovation framework for the United States.”

One of the biggest challenges? The rise of memecoins—celebrity-driven tokens that many in the industry see as a credibility risk. Pump-and-dump schemes have left investors burned, and regulatory oversight remains murky.

Regulatory reversal

Trump’s crypto push represents a complete reversal from Biden-era crackdowns. The new SEC chairman, Paul Atkins, has already dropped cases against Coinbase and Kraken, while banking restrictions on crypto holdings have been lifted. Sacks slammed the previous administration for treating crypto founders “like criminals” without offering clear regulations.

Still, shaping those rules will require Congress to step up. With legislation stalled despite intense lobbying, the crypto world is watching closely to see if Trump’s promises translate into lasting change—or if this is just another speculative bet.