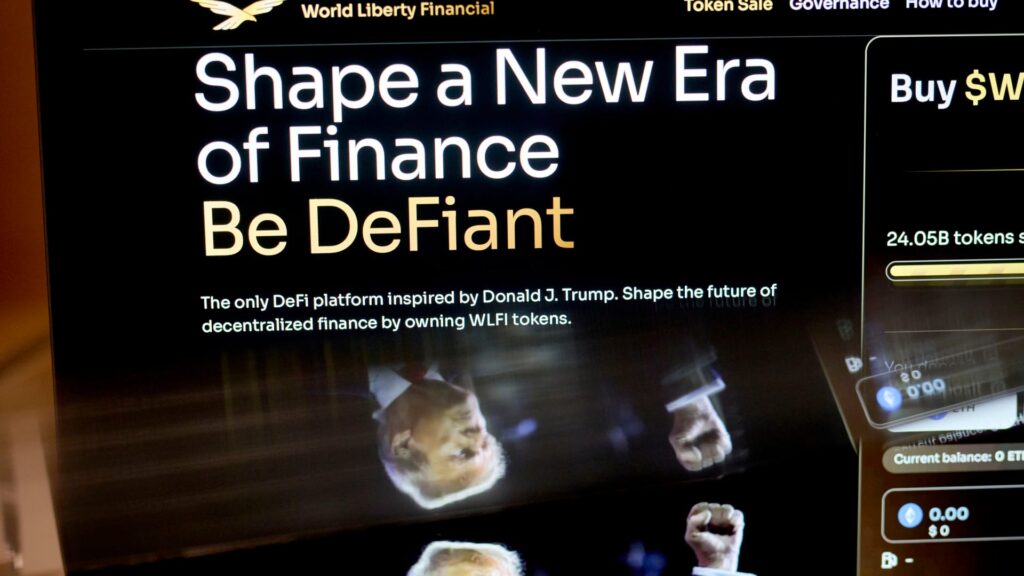

The World Liberty Financial website arranged on a smartphone in New York, US, on Wednesday, Feb. 12, 2025.

Gabby Jones | Bloomberg | Getty Images

President Donald Trump’s World Liberty Financial crypto project said on Monday that it raised $250 million in its second token sale, bringing the total amount of coins sold to $550 million.

WLFI, a venture backed by the first family that describes itself as a sort of crypto banking platform, launched in October, weeks before Trump’s election victory. In a document published at the time of launch, WLFI said the Trump family could take home 75% of net revenue.

In Monday’s release, WLFI said more than 85,000 participants underwent so-called know-your-customer verification to gain access to the token sale. Co-founder Zach Witkoff, son of billionaire U.S. envoy Steve Witkoff, is quoted in the release as saying that “WLFI is on track to supercharge DeFi,” or decentralized finance.

In January, Tron blockchain founder Justin Sun upped his stake in WLFI tokens to $75 million. A court filing the following month showed that Sun and the SEC were exploring a resolution to the regulator’s civil fraud case against the crypto entrepreneur.

WLFI is one of several crypto projects in the Trump family that are kicking off just as the president is pushing a crypto-friendly agenda. Earlier this month, President Trump signed an executive order to establish a Strategic Bitcoin Reserve.

According to a memo from the White House last week, David Sacks, the Trump administration’s AI and crypto czar, sold over $200 million worth of digital asset-related investments personally and through his firm, Craft Ventures, before starting the job. Sacks said in a podcast that he “didn’t want to even have the appearance of a conflict.”

At the end of February, the SEC declared that meme tokens are not securities. The announcement came after the president and First Lady Melania Trump launched their own meme coins in the days leading up to the inauguration.

WATCH: Trump’s bitcoin reserve leaves crypto investors disappointed