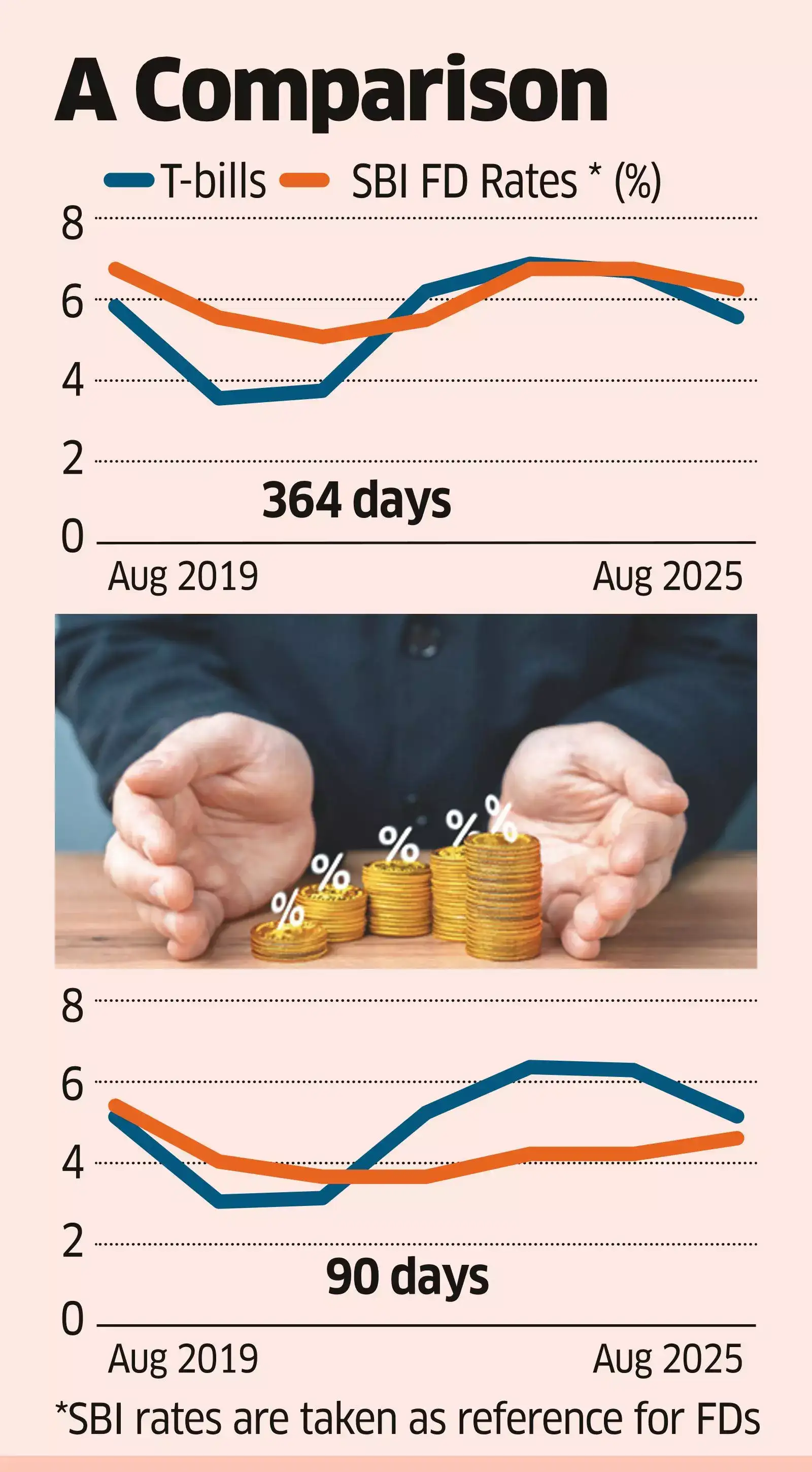

The Reserve Bank of India (RBI) has allowed individuals to invest in Treasury bills (T-bills) through the systematic investment plan (SIP) route on its retail direct platform, aiming to boost retail participation in the bond market.An ET analysis shows that while bank fixed deposits (FDs) offer at least 68 basis points (bps) higher returns in the one-year segment, T-bills outperform in shorter tenures — providing about 55 bps more than FDs in 91-day and 182-day maturities.

The central bank had earlier opened trading in government securities to retail investors. The latest decision to permit SIP-based investment in T-bills allows participation with a minimum investment of Rs 10,000, along with options for auto-bidding and reinvestment on the platform.Auto-bidding enables investors to automate their participation in the weekly T-bill auctions held every Wednesday. The system places bids at the cut-off rate on behalf of investors for the chosen amount. The reinvestment option allows proceeds from maturing T-bills to be automatically deployed in fresh issuances.Launched in November 2021, the RBI’s retail direct platform was designed to make government securities more accessible to individual investors. Registrations on the platform have doubled in the past two years to nearly half a million, though experts note that overall participation levels remain modest.The analysis suggests that for investors seeking short-term exposure, T-bills via SIP can offer a competitive edge over similar-tenure FDs, while one-year deposits continue to lead on returns.