The CBDT (Central Board of Direct Taxes) has successfully collected ₹20,000 crore in pending dues during the first quarter of the current financial year, representing a twofold increase compared to the corresponding period last year. These collections were in response to demand notices issued by the income-tax department through March 31.Officials indicate that collection efforts will become more rigorous in the upcoming months, with the department aiming to recover ₹1.96 lakh crore this fiscal year. The tax authority is currently working to identify instances where taxpayers are suspected of income under-reporting or deliberate tax evasion.Officials told ET that the recovered amount had ₹17,244 crore in corporate tax, ₹2,714 crore in personal income-tax, and ₹180 crore from inadequate or non-payment of tax deducted at source.Also Read | ITR filing FY 2024-25: New versus old income tax regime – what helps you save more tax? Check calculations before filing return“In the last few years, recovery has been good and this year our target is to touch at least Rs 2 lakh crore, and we will comfortably achieve it,” a senior official was quoted as saying.

CBDT Income Tax Recovery

The Central Board of Direct Taxes has instructed regional offices to accelerate collections by establishing specific recovery targets for each zone, particularly focusing on cases where initial appeals have ruled in favour of the tax department.Tax assessment officials have received directives to implement comprehensive measures for collecting pending dues that have been validated by the Commissioner of Income-tax (Appeals) during the primary appeal phase.

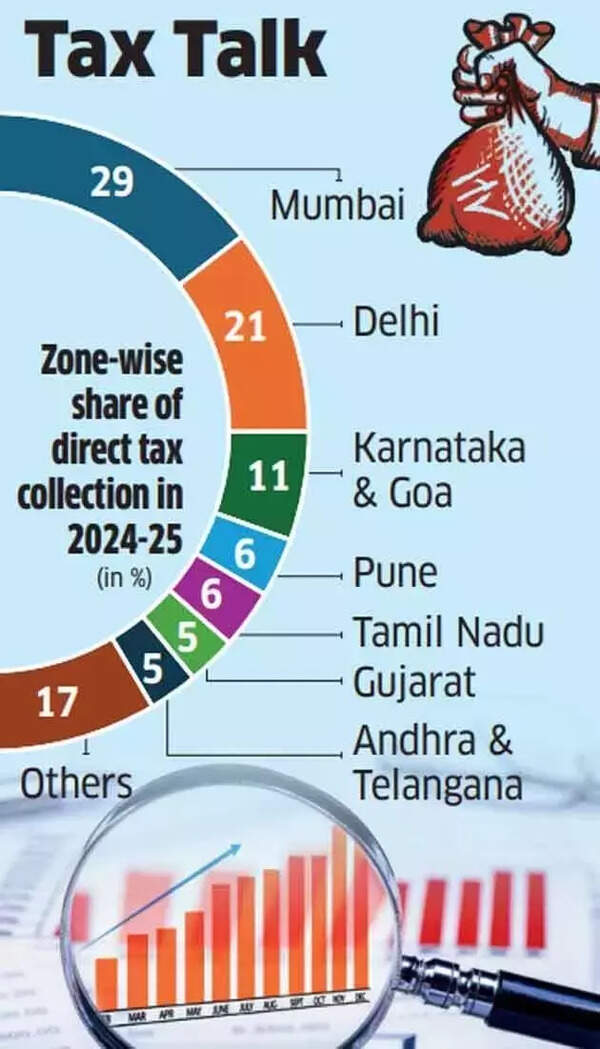

Tax Talk

The official mentioned that during 2024-25, demands confirmed fully in the revenue department’s favour reached ₹1.96 lakh crore from resolved appeals.During 2024-25, the CBDT successfully collected ₹92,400 crore in outstanding payments, comprising ₹67,711 crore in corporate tax, ₹23,536 crore in personal income-tax, and ₹1,100 crore related to unpaid tax deducted at source.Also Read | ITR filing: Why are ITR-2 and ITR-3 forms still not available on Income Tax e-filing portal? Top reasons explainedTax arrears have emerged as a significant challenge for the department.The income-tax department’s pending tax demands saw a substantial rise, reaching ₹42 lakh crore as of October 1, 2024, compared to ₹10 lakh crore in 2019-20, as detailed in the parliamentary standing committee on finance report. The department aims to recover ₹27 lakh crore from this outstanding amount.