Mumbai: Tata Capital’s board has given its nod on Tuesday for the financial company to go public, setting the stage for one of the largest IPOs in the country this year. The offering will comprise a fresh issuance of up to 23 crore shares along with a stake-sale by existing shareholders.

While the exact value of the offering was not specified, D-Street suggests an IPO size of $1.7 billion. The IPO is to comply with RBI’s requirement for ‘upper-layer’ NBFCs to list their shares by Sept.

This will be the second IPO from Tata Group within two years, following Tata Technologies’ street debut in Dec 2023.

Despite market volatility, the IPOs remain robust with Tata Capital joining companies like LG India (potential IPO size of $1.5 billion), JSW Cement and Ather Energy in pursuing public listings.

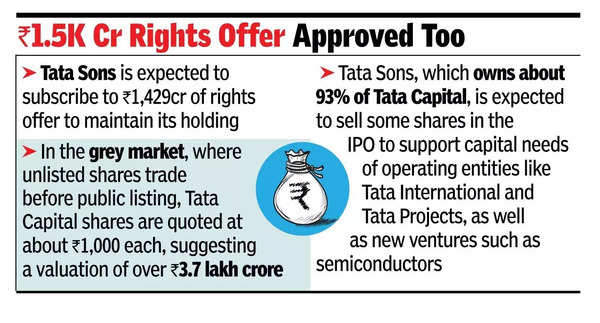

Tata Sons, which owns about 93% of Tata Capital, is expected to sell some shares in the IPO to support capital requirements of operating entities like Tata International and Tata Projects, as well as new ventures such as semiconductors. Other shareholders of Tata Capital include various Tata Group entities, current and former Tata Group employees, and the Washington-based International Finance Corporation.

Tata Capital’s board has also approved a rights offering of Rs 1,504 crore. Tata Sons is expected to subscribe to Rs 1,429 crore of the rights offering to maintain its current holding. Its total investments in Tata Capital stand at Rs 9,403 crore since the financial services company’s inception, highlighting its significance within Tata Group.

“The rights offering establishes a reference valuation price before the IPO and provides an indication to Tata Capital’s market capitalisation upon listing,” said Katalyst Advisors’ executive director Binoy Parikh. In the grey market, where unlisted shares trade unofficially before public listing, Tata Capital shares are quoted at about Rs 1,000 each, suggesting a valuation exceeding Rs 3.7 lakh crore.

According to Fitch Ratings’ recent note, Tata Sons’ ownership in Tata Capital is unlikely to drop below 75% post-listing, with the IPO strengthening the company’s capital position and reducing leverage.

While Tata Sons too has been directed by RBI to list its shares by Sept, it has sought ‘deregistration’, which the regulator confirmed in Jan as under “examination”.