NEW DELHI: It isn’t just small cars and two-wheelers, large sedans and SUVs too are likely to see a sharp reduction in prices as goods and services tax (GST) is expected to come down from the current, up to 50%, to proposed 40%, the slab for luxury and sin goods.But, there is also the fear that the GST Council may come up with a new cess on higher-end vehicles. At a ministerial panel meeting on rate rationalisation on Thursday, some states demanded a cess on top of the 40% tax. Currently, SUVs and sedans over four metres in length and engine capacity above a certain level attract 28% GST and 22% cess.A final decision on rates will be taken by the GST Council, led by Union finance minister Nirmala Sitharaman next month, amid indications that the Centre is keen on a flat 40% levy on a handful of sin and luxury goods without any cess.

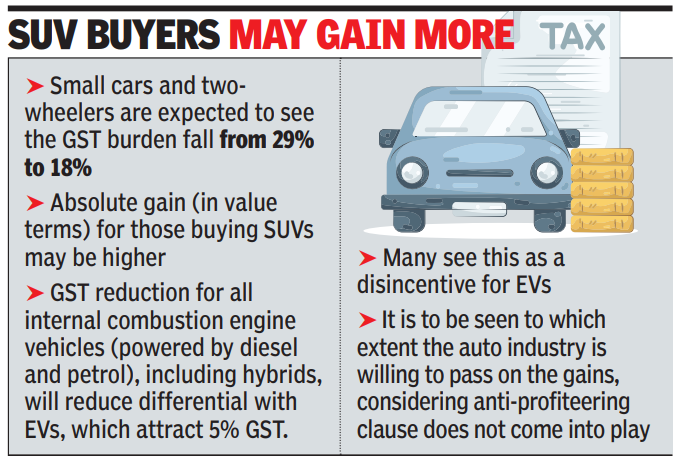

Govt sources had said that cess will be removed as it was to be levied for five years to “compensate” states for “revenue loss” due to GST implementation, but was extended by another three years to cover losses due to Covid.While small cars and two-wheelers are expected to see the burden fall from 29% to 18%, the absolute gain (in value terms) for those buying SUVs may be higher.The reduction for all internal combustion engine vehicles or those powered by diesel and petrol, including hybrids, will reduce the differential with electric vehicles, which attract 5% GST. Many see that as a disincentive for EVs, particularly in the more price-sensitive segment of two-wheelers, where the difference in GST will be 13 percentage points compared to 23 percentage points currently. EVs have a higher capital cost but lower operating cost, with purchase price often acting as an entry-level barrier.A concern among consumers and in govt circles is regarding the auto industry’s willingness to pass on the gains, given that the anti-profiteering clause does not come into play. Although the auto industry is often accused of pocketing the gains, government sources said there will be pressure on companies to pass on the benefits, especially to boost demand, amid sluggish sales.