[ad_1]

Arpit Kulshrestha

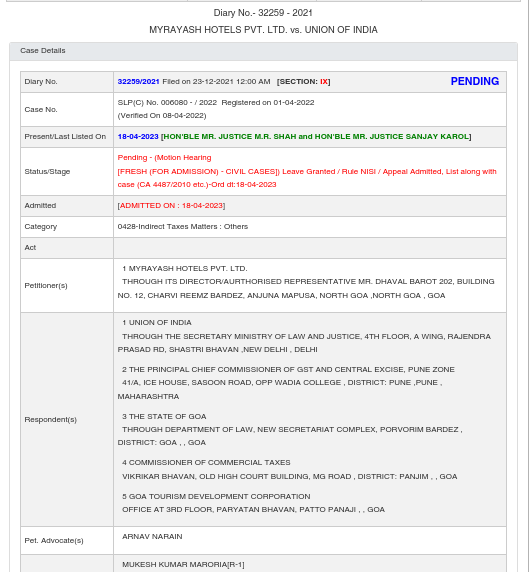

In a civil appeal that is currently pending before the bench of nine judges, the Supreme Court mentioned a case that addressed the question of the constitutional legality of GST on lease/rent payments.

According to the ruling of a bench comprising of Justice M.R. Shah and Justice Sanjay Karol, there is no stay against the recovery, and the Revenue Department is free to pursue the tax recovery under the law.

The Central Goods and Services Tax Act of 2017 and the Goa Goods and Services Tax Act of 2017’s Paragraphs 2 and 5(a) were challenged in a writ petition filed by the petitioner, Myrayash Hotels Pvt. Ltd., before the Bombay High Court.

According to Article 246A of the Indian Constitution, the petitioner claimed that only “goods and services” are subject to the GST tax. There is no “service” offered by the lessor or landlord to the lessee or tenant if the agreement is a lease or rent contract. Therefore, it cannot be subject to GST. Under Entry 49, List II of the Seventh Schedule of the Constitution of India, only the state legislatures have the authority to tax transactions involving real property. Therefore, a GST duty on such a lease or rental transaction is prohibited by Article 246A.

The petitioner claimed that when a lease is granted by the lessor/landlord to the lessee/tenant via a lease, the lessor/landlord abdicates all rights to use and enjoy that immovable property for the duration of the lease or rent period.

Read Also: COSIA: Govt to Resolve GST Issue Over Land Lease Transactions

According to the Bombay High Court, as long as the tax does not fall under List II of the Seventh Schedule and as long as the service tax was enacted under the residuary power of legislation, one cannot question the expectations of Parliament that there is a service element in the lease of land.

In addition to filing an SLP with the Supreme Court of India, the petitioner questioned the Bombay High Court’s ruling and the constitutionality of the GST imposed on lease or rent payments.

The petitioner hired senior lawyer Kavin Gulati, who argued that the GST levy on these lease or rent contracts was wholly unconstitutional and that the petitioner shouldn’t be held responsible for paying the GST on such lease rentals, premiums, or payments made concerning the lease.

While granting the petitioner’s request for leave to appeal, the Supreme Court of India also decided to admit the appeal and ordered that it be considered concurrently with Civil Appeal No. 4487 of 2010, which is currently before a bench of 9 justices.

[ad_2]

Source link