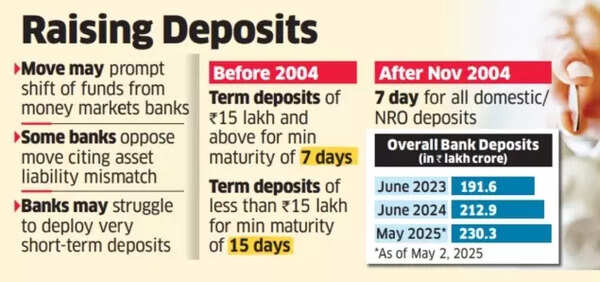

Sub-7 day fixed deposits soon? The Reserve Bank of India (RBI) has requested feedback from banks regarding the possibility of offering term deposits with durations shorter than seven days. Banks are required to provide their input before the end of the current month, according to sources.“The move may allow banks to set their own tenure, boosting fixed deposit attractiveness and liquidity in the banking system,” said a bank executive.This initiative follows a decline in deposit growth, which decreased to 10% year-on-year as of May 02, 2025, compared to 13% in the previous year.

Raising deposits

The latest SBI Research report indicates that swift rate cut transmission results in immediate downward pressure on deposit rates, making deposit collection particularly challenging for banks.In 2004, the banking regulator reduced the minimum duration requirement for domestic and non-resident ordinary (NRO) term deposits from 15 days to one week.According to an ET report, the RBI conducted separate consultations last month with major institutions including State Bank of India, Punjab National Bank, and private sector banks like Axis Bank regarding this matter.The official noted that these discussions are in their early stages, and the RBI has not yet confirmed whether banks will be granted autonomy in determining deposit tenures.Also Read | ITR filing FY 2024-25: What’s new this year? Top things every taxpayer should know before income tax return filingThe IBA plans to submit its response by the end of the month after consulting with a broader range of banking institutions.Nevertheless, the proposal has received mixed reactions from various banks. “Some banks have made suggestions against removing the minimum week-long tenure for fixed deposits and cited asset liability mismatch (ALM) as the key impediment,” said the executive.The ALM risk occurs when the maturity periods of assets and liabilities do not align, such as when short-term deposits fund longer-duration loans, potentially creating liquidity concerns for banks.A senior official from a public sector bank indicated that whilst fixed deposits shorter than seven days might benefit companies seeking better returns on brief surplus funds, they might not be advantageous for banking institutions.“Banks will find it difficult to find avenues to lend such short-tenure loans, like for five or three days. Even today, most of these seven- to 10-day loans are to cover forex transactions,” he said.