Stock market crash: The Indian stock market has experienced a consistent decline since late September, eliminating all gains achieved by benchmark indices over the past year. The Nifty 50 and Sensex have decreased by 1.4% and 1.2% respectively in yearly returns, with Nifty’s Smallcap 250 showing the steepest decline at 7.7%. This reduction in yearly returns affects investor confidence, with individual investors particularly reluctant to invest additional funds due to diminishing portfolio values.

Since September 27, 2024, the Sensex and Nifty have declined by over 17% and 18% respectively. The Midcap 150 index has fallen by 20.3%, while the Smallcap 250 and Microcap 250 indices have decreased by 24.4% and 23.8% respectively.

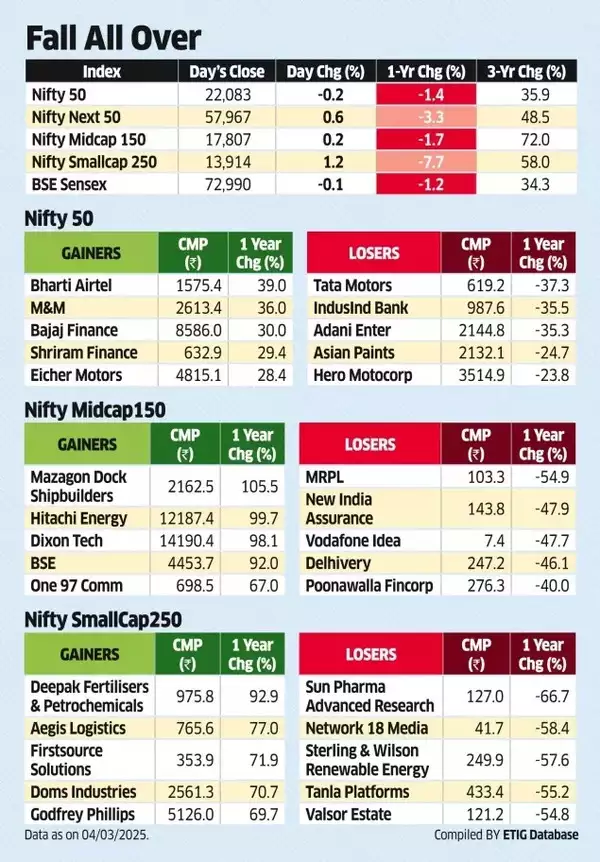

The most significant declines occurred in midcap and smallcap segments, with some shares falling between 55-67%. Among Nifty 50 companies, Tata Motors, IndusInd Bank and Adani Enterprises recorded the largest decreases, each exceeding 30%, whilst Bharti Airtel, M&M and Bajaj Finance emerged as the leading gainers.

Stock market crash: Fall all over

“We have seen volumes drop by over 40% compared to last year’s peak in the cash market,” Sandip Raichura, CEO-retail broking and distribution at PL Capital told ET. “This is due to first-time investors who are seeing their first correction and exiting , along with large clients like treasuries and HNIs (high networth individuals) unwilling to bet big in the current weak scenario.”

According to Raichura, short-term market increases might trigger additional selling, with substantial recovery likely to begin in large-caps before extending to mid- and small-caps. “And until we see a strong recovery, investors may not entirely return to the stock market,” he said.

Also Read | Stock market crash: Sensex, Nifty are bleeding! Why it may be time to put your money in gold, silver, FDs, bonds & other investment avenues

Narendra Solanki, head fundamental research-investment services at Anand Rathi Shares and Stock Brokers, told the financial daily that this marks only the third instance where 90% of Nifty 500 stocks have fallen below their 200-DMA levels, currently at 24,070. “Usually in such cases, there are bounce backs in the market, but the beginning of such a recovery is not yet in sight.”