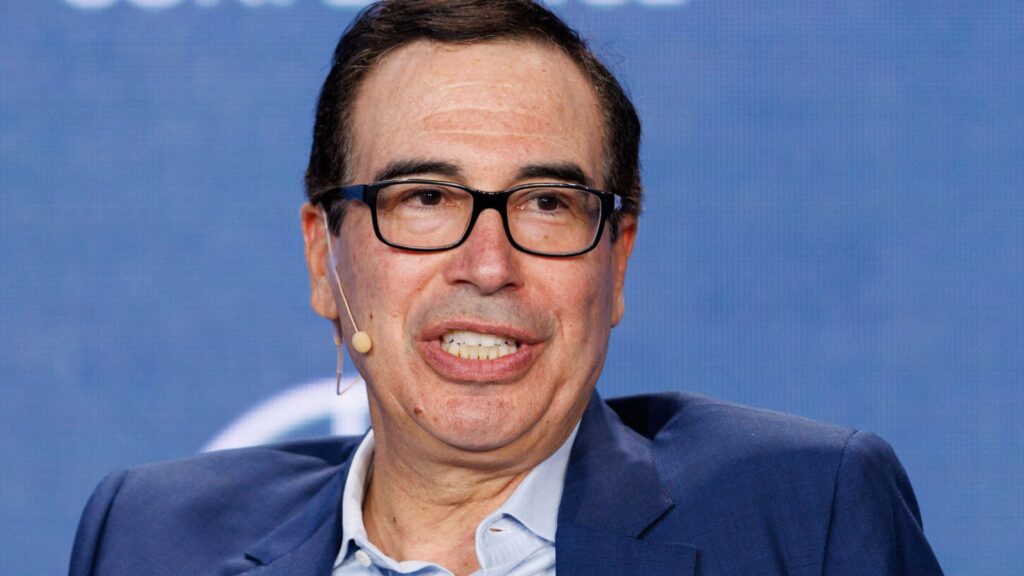

Former Treasury Secretary Steven Mnuchin said Wednesday he believes “people are overreacting a bit” to the policy changes from the current Trump administration.

Mnuchin, who served in President Donald Trump’s Cabinet during the Republican’s first term in office, told CNBC’s “Squawk Box” that he does not see signs of an imminent slowdown for the U.S. economy.

“I don’t think we’re going to have a recession. I don’t think the outlook looks like we’re going to have a recession. And Larry Summers saying there’s a 50% probability, I just don’t agree with that,” Mnuchin said, referring to recent commentary from another former Treasury head.

The first few months of Trump’s second term have been marked by escalating trade tensions between the U.S. and its major trading partners of Canada, Mexico and China. The White House has repeatedly announced and then rolled back tariffs. The federal government has also been slashing jobs. Those factors seem to have contributed to recent declines in confidence surveys of consumers and small business owners.

The Federal Reserve Bank of Atlanta’s GDPNow tracker currently projects that the U.S. economy will contract in the first quarter. However, that projection is an outlier relative to most Wall Street economists who are generally forecasting modest growth.

Mnuchin also addressed the recent pullback in the stock market, pointing out that the declines have come from high levels. On Tuesday, the S&P 500 closed 9.4% below its record high, and the tech-heavy Nasdaq Composite closed 13.7% off its high-water mark.

“I don’t think anybody should look at what’s a natural, healthy correction of these indexes as indicating that the economy’s in trouble,” he said.

Mnuchin, a former Goldman Sachs executive, was widely seen as a steadying presence in the first Trump administration and was one of the chief architects of the economic support plans during the Covid-19 pandemic.

He said Wednesday that he did not focus on the day-to-day stock market moves when he was leading the Treasury Department but viewed them as a good “barometer” long term. Trump has said in recent days that he is not paying attention to the stock market.

Since leaving office, Mnuchin has been running the investment firm Liberty Strategic Capital.