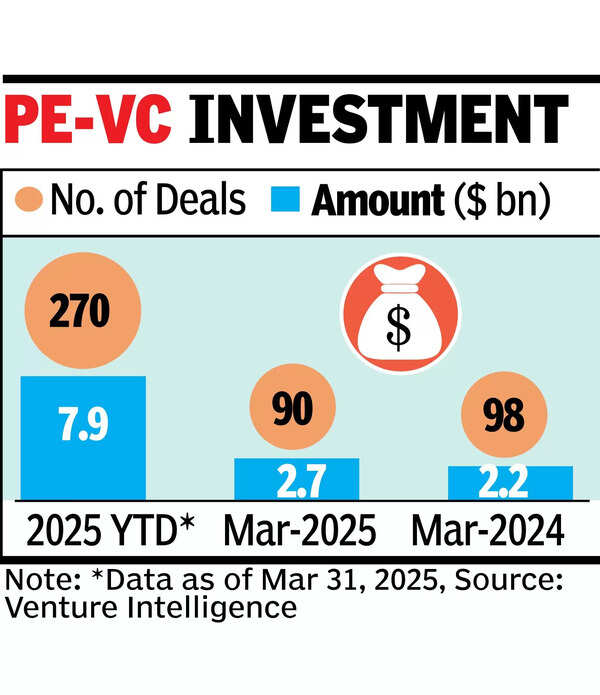

CHENNAI: Private equity-venture capital (PE-VC) investments grew 10% during Jan-March 2025 to $7.9 billion from $7.2 billion in the year-ago period. PE investments exclude those from the real estate sector. In March, PE-VC investments stood at $2.7 billion – an increase of $500 million compared to March 2024 – Venture Intelligence data showed.

Bain Capital‘s investment of about Rs 4,390 crore in Kerala-based NBFC Manappuram Finance topped the list of PE-VC investments in March. It was followed by around $163 million investment by Actis in Stride Climate Investments. HR tech platform Darwinbox’s $140-million raise in a round co-led by PE firm Partners Group and investment firm KKR emerged as the third top deal.

“The fact that global PE firms such as Bain and KKR, as well as home grown firms like Kedaara have announced very significant investments in March, points to the confidence such late-stage investors have in the Indian private markets,” Arun Natarajan, founder, Venture Intelligence told TOI.