India’s Largest Pvt Debt-Raise In Domestic Currency To See Participation Of 15 Investors

MUMBAI: Five private credit funds, including Davidson Kempner Capital Management, Cerberus Capital Management and Ares Management Corp, will provide 75% (about $2.5 billion) of the $3.3 billion funding that the Shapoorji Pallonji Group is securing in India’s largest domestic currency private debt arrangement. Farallon Capital Management and One Investment Management are the other two participating funds.

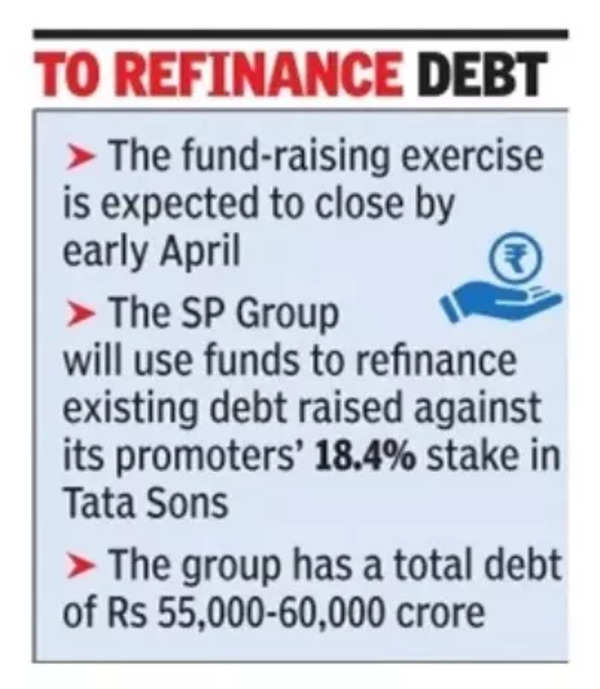

In total, 15 investors will participate in SP’s $3.3 billion (about Rs 28,600 crore) fund-raising programme, with completion anticipated by early April.

The 160-year-old Shapoorji Pallonji Group, known for constructing iconic structures in Mumbai like RBI building, will use the funds to refinance existing debt raised against its promoters’ 18.4% stake in Tata Sons, the holding company of the $165 billion Tata Group.

The funds are being raised by Evangelos Ventures, equally owned by SP Group chairman Shapoor Mistry and his nephews Firoz Mistry and Zahan Mistry. The rupee-denominated bonds will carry a high-teens interest rate, extend over 3.5 years, and will be listed on the BSE.

.

In 2022, Goswami Infratech, which owns 25% of SP Group company Afcons Infrastructure, secured $1.6 billion (then about Rs 14,300 crore) from a group of 10 investors at 18.75% interest. The current interest rate will exceed the 2023 rate, said a person in the know, adding that Evangelos will also be responsible for the tax obli gations on investors’ interest earnings.

SP Group has a total debt of Rs 55,000-Rs 60,000 crore, with half belonging to the promoters (Mistry family) and the other half belonging to operating real estate and construction companies.

The proposed fund-raise of Rs 28,600 crore will be used to refinance Goswami Infratech and promoters’ debt, with the remainder addressing SP Group’s operational entities’ debt. Goswami Infratech’s bonds are scheduled for maturity this month.

SP Group’s latest fund raising effort follows after an unsuccessful attempt to raise Rs 20,000 crore from Power Finance Corporation last year. Despite asset sales and initial public offerings of group operating entities, leverage remains a concern for the conglomerate. Its financial performance has suffered due to high-cost construction projects and working capital constraints during the Covid-19 pandemic and the IL&FS crisis.