HYDERABAD: Breaking out from the shadows of glittering gold, silver hit a record Rs 1,13,000 a kg on MCX late Friday. It came on the back of international prices hit a 13-year high of $37.8/Oz in the spot market and $38.7 in futures, amid rising trade worries after US President Donald Trump returned with reciprocal tariff announcements this week.“On MCX, silver prices surged to a new all-time high influenced by positive cues from the overseas market. In the international market, spot silver trading reached its highest level in over 13 years, driven by intensifying global trade tensions that increased demand for safe-haven assets, fuelling the rally,” said Saumil Gandhi, senior analyst -commodities, HDFC Securities.Gandhi pointed out that gold too rose on Friday to set a new weekly high of $3,356 (Comex Spot) as rising trade worries offset a steady US dollar after Trump slapped a 35% tariff on Canadian imports from Aug 1 and signalled plans for 15-20% blanket tariffs on most other trade partners.

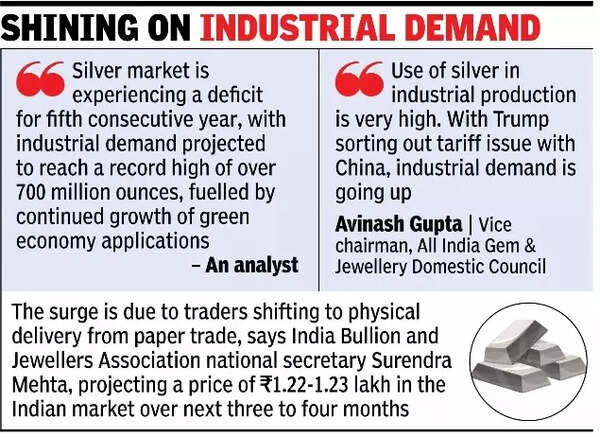

Besides, silver is in short supply. “The silver market is experiencing a deficit for the fifth consecutive year, with industrial demand projected to reach a record high of over 700 million ounces, fuelled by the continued growth of green economy applications,” Gandhi added.High industrial demand is driving prices. “The use of silver in industrial production is very high. With Trump sorting out the tariff issue with China, industrial demand is going up,” said All India Gem & Jewellery Domestic Council VC Avinash Gupta.India Bullion and Jewellers Association national secretary Surendra Mehta also attributed the surge to traders shifting to physical delivery from paper trade and projected a price of $42 in the international market and Rs 1.22 -1.23 lakh in the Indian market over three to four months.