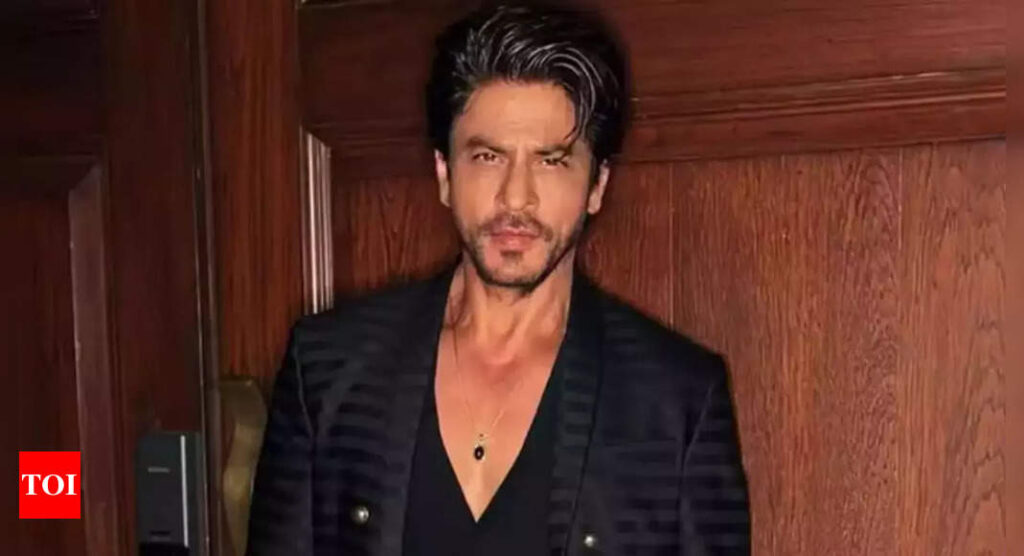

Bollywood superstar Shah Rukh Khan has achieved a significant legal victory in a protracted tax dispute concerning his remuneration for the 2011 film ‘Ra.One’. The Income Tax Appellate Tribunal (ITAT) ruled in his favour, dismissing the reassessment proceedings initiated by the Income Tax Department for the financial year 2011-2012.

As per Business Standard, The dispute began when Shah Rukh Khan declared an income of Rs 83.42 crore for the assessment year 2012-13, including earnings from ‘RaOne‘. However, the tax officer rejected his claims for foreign tax credit (FTC) for taxes paid in the UK, leading to a reassessment of his income at Rs 84.17 crore. This reassessment occurred more than four years after the relevant assessment year, which is beyond the statutory limit under Section 147 of the Income Tax Act.

As part of his agreement with Red Chillies Entertainment, a company he founded, 70% of ‘RaOne’ was filmed in the UK. Consequently, an equal percentage of his income was subject to UK taxes. To facilitate this arrangement, his remuneration was routed through Winford Production, a UK entity. The tax authorities argued that this arrangement resulted in a revenue loss for India and thus denied his claim for a foreign tax credit.

The ITAT bench held that the reassessment of Shah Rukh Khan’s case by the income-tax department was not legally justified. The assessing officer failed to provide “any fresh tangible material warranting a reassessment beyond the four-year statutory period”. This ruling marks a significant victory for the actor in his prolonged battle over foreign tax credit claims.

While the actor has not made any official comments on the ruling. Amidst this legal development, Shah Rukh Khan continues his professional engagements. He is currently working on his next film, titled ‘King’, which also features his daughter, Suhana Khan.