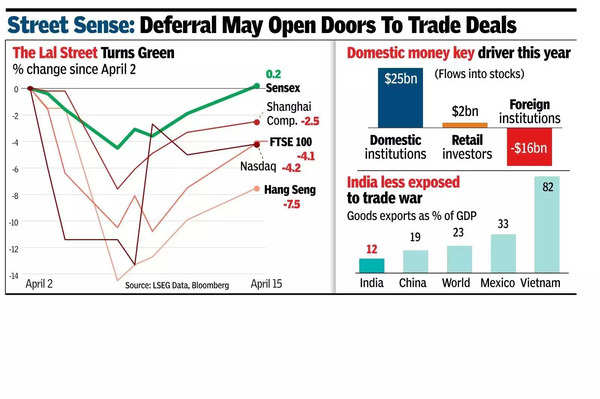

MUMBAI: A thaw in tariff-related developments around the world on Tuesday lifted investor sentiment on Dalal Street, leading to a 1,578 point (2.1%) rally in the sensex, which closed at 76,735 points.

This rise made it the first major market in the world to recoup all its losses post April 2. Nifty on the NSE also rose sharply, closing 500 points (2.2%) higher at 23,329 points, just three points off its April 2 close.

On that day, US President Donald Trump announced new tariff rates for almost all of America’s trading partners. A global market turmoil followed as investors feared retaliations by those countries affected by the new tariff rates, which they thought could lead to a global economic recession.

After a week of turmoil, Trump suspended the implementation of most of the new tariffs, scaled back some, or exempted some items from them. However, new tariff rates on China continue.

Since volatility in global markets has abated in the last few days, foreign investors are returning to buy stocks in relatively riskier markets like India, market players said. On Tuesday, net buying by foreign funds in domestic stocks was worth Rs 6,066 crore, while domestic funds were net sellers at Rs 1,952 crore.

According to Ajit Mishra of Religare Broking, Tuesday’s rally was mainly driven by optimism around the deferral of tariffs and the recent exemptions on select products, “raising hopes for potential negotiations that could ease the overall impact on global trade”. It was also supported by positive global cues. “Adding to the bullish sentiment, the sharp 20% decline in India VIX is a positive sign,” Mishra said.

The day’s rally was also aided by a strengthening rupee, which closed 27 paise up at 85.77 to a dollar, from 86.04 in the previous session.

Among sensex stocks, Tata Motors closed 4.5% up on the back of talks that the automobile sector may get some relief from the imposition of tariffs by the US.

A host of banking stocks gained after most of the leading banks cut deposit rates following a rate cut by RBI last week. Sector analysts feel that the move to lower deposit rates could increase net interest margin for banks, which in turn could lift their bottom line.