Bulls Trump Bears On D-St, At Least For Now, Even As Chaos Engulfs Wall St Amid Escalating Trade War, Fed’s Wait-&-Watch Talk

Hopes Of Further Rate Cuts, ‘Normal’ Monsoon Lift Street Spirits

MUMBAI: Strong buying in stocks of banking and financial services companies, along with Reliance Industries, led to a more than 1,900-point intraday reversal in the sensex on Thursday, while technology stocks were the laggards.In the process, Dalal Street investors ignored the overnight selloff on Wall Street as foreign fund managers continued to buy domestic stocks.

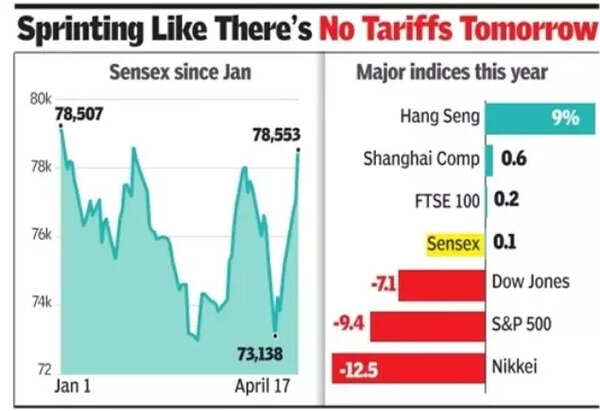

During the day, weighed down by a weak closing in the US market the previous night, the sensex opened in the red and was down more than 350 points early in the session. However, soon the trend reversed, and in late trades, the sensex was up nearly 1,600 points. At close, the index was up 1,509 points or 2% at 78,553 points. The index regained the 78,000 mark after more than three weeks. On the NSE, Nifty also follo wed a similar path and closed 414 points or 1.8% higher at 23,852 points.

According to a note by Bajaj Broking, banking stocks were the standout performers on Thursday, rallying on the back of easing retail inflation numbers for March and a normal monsoon forecast for the June-September period. These two factors bo osted hopes of a deeper rate cut cycle by the RBI.

The day’s rally was mainly aided by foreign funds that net bought stocks worth Rs 4,668 crore. In the truncated three-session trading week, foreign portfolio investors net bought stocks worth nearly Rs 15,600 crore (about $1.8 billion). On the other hand, domestic funds were net sel lers. On Thursday, their net selling was worth a little over Rs 2,000 crore.

The day’s rally also added about Rs 4.6 lakh crore to investors’ wealth, measured by BSE’s market capitalisation, which was at Rs 419.6 lakh crore. Stock markets will be closed on account of Good Friday on April 18, the exchanges said.