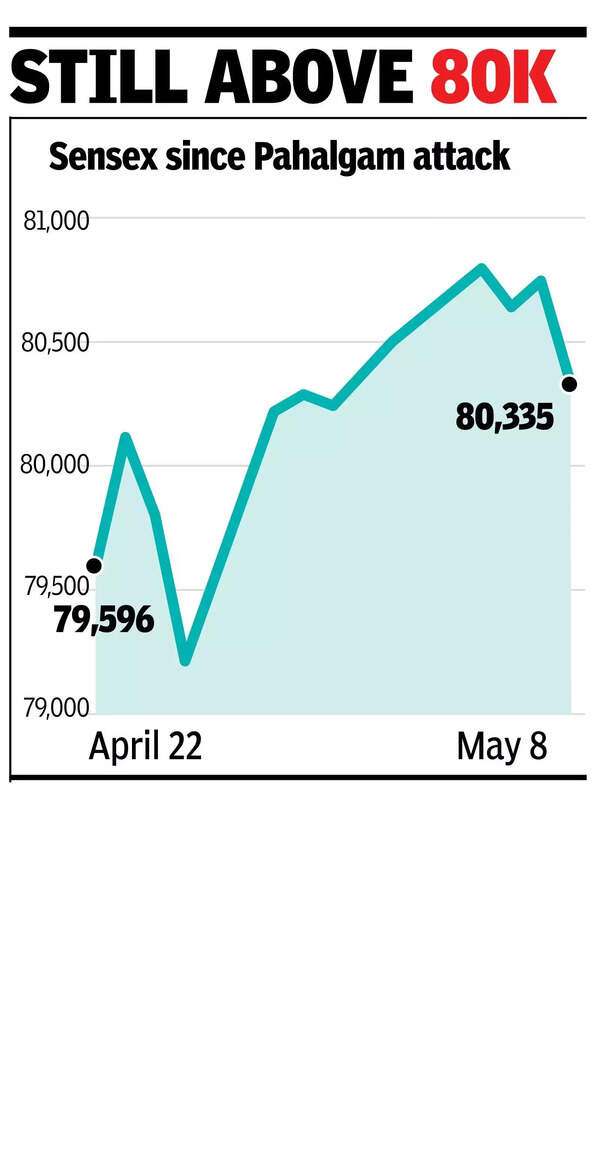

MUMBAI: News of India’s retaliatory strikeS on select Pakistani military assets in the intervening night of Wednesday and Thursday left investors jittery during the fag end of Thursday’s session.As a result, after treading steadily for most of the day, thesensex dived sharply during the closing hour and ended 412 points or 0.5% lower at 80,335 points. Nifty lost 141 points or 0.6% to close at 24,274 points.IT and select bank stocks cushioned the fall, BSE data showed. The expiry of weekly derivatives contracts also added to the day’s volatility, market players said. With Indo-Pak border tensions escalating on Thursday evening, Friday’s session could be volatile, market players noted.

According to Vinod Nair of Geojit Investments, on Thursday the domestic market experienced profit-booking by the end of the trading day due to escalating tensions between India and Pakistan, marked by increased cross-border exchanges. “The US FOMC policy meeting provided little reassurance, as the Fed expressed concerns that aggressive US tariffs could fuel inflation and raise unemployment.”The day’s slide left investors poorer by Rs 5 lakh crore, with BSE’s market capitalisation now at Rs 418.5 lakh crore. The day’s slide was seen despite strong foreign fund buying. At the close of trading, foreign portfolio investors were net buyers at Rs 2,008 crore, while domestic funds were net sellers at Rs 596 crore.Among the 30 sensex stocks, 21 closed in the red zone while nine closed in the green.Friday’s session on Dalal Street could be volatile on the back of Pakistan’s drone attack on western Indian places along its border. At 10pm, the GIFT Nifty futures contracts were trading 1.1% lower.