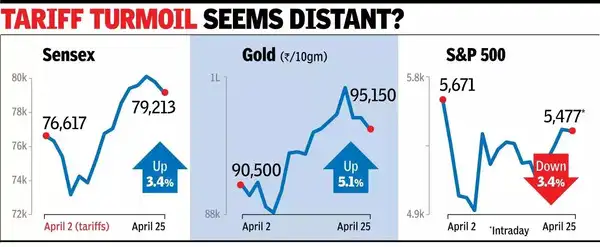

MUMBAI: India-Pakistan border tensions spooked Dalal Street investors on Friday, with the sensex closing 589 points down at 79,213 points, while Nifty on the NSE lost 207 points to 24,039 points. Some profit-taking after a seven-session gain that added about 8.5% to each of the indices also led to the slide in the indices, market players said.

After opening marginally higher, sensex lost steam and dipped to the day’s low at 78,606 points, down nearly 1,200 points from Thursday’s close. However, end-of-the-session buying, mainly by foreign funds, helped it recover part of its early losses.

Although both sensex and Nifty closed less than 1% lower, the selloff was severe outside blue-chip stocks.

As a result, BSE’s midcap index closed 2.4% down, while the smallcap index was down 2.6%. According to Vinod Nair of Geojit Investments, investor sentiment turned cautious amid escalating tensions along the Indo-Pak border. “Mid and smallcap stocks bore the brunt of the sell-off, driven by their elevated valuations and growing concerns over potential earnings downgrades following a muted start to the earnings season.” The day’s selloff left investors poorer by Rs 8 lakh crore, with BSE’s market capitalisation now at Rs 421.6 lakh crore.

The slide in the leading indices came despite a Rs 2,952-crore net buying by foreign funds, BSE data showed. After remaining bearish on India for several months, foreign portfolio investors (FPIs) are showing signs of being bullish again. Since April 16, FPIs net bought stocks worth Rs 31,200 crore (about $3.7 billion), data from NSDL and BSE showed. The recent surge in buying by FPIs has now put the net outflow figure for fiscal 2026 at just Rs 5,678 crore, NSDL data showed.

Canara Robeco AMC files draft papers for IPO

Canara Robeco AMC, which runs the Canara Robeco Mutual Fund, on Friday said it filed draft papers with markets regulator Sebi for an IPO.