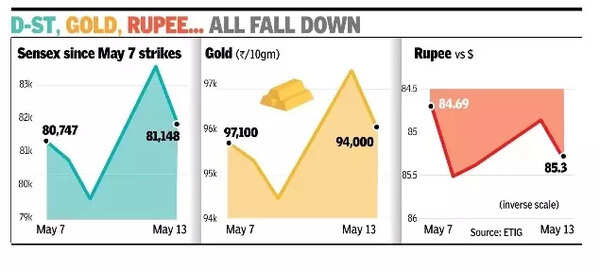

MUMBAI: A record 2,975-point sensex rally gave way to profit-takingon Tuesday, with the index closing nearly 1,300 points down. Banks, IT and Reliance Industries, the sectors and stocks that rallied the most in the previous session, were the most sold on Tuesday.The slide came asforeign funds turned into big sellers, exchange data showed.The sensex on Tuesday opened slightly up but soon entered negative territory and slid through the session. It closed 1,282 points or 1.6% lower at 81,148 points. On the NSE, Nifty lost 346 points or 1.4% to close at 24,578 points.

According to Ajit Mishra of Religare Broking, Tuesday’s dip in the index reflects caution among investors despite easing geopolitical tensions and stable global cues. The day’s session left investors poorer by nearly Rs 1.5 lakh crore, with BSE’s market capitalisation now at Rs 431.1 lakh crore, official data showed.Tuesday’s selling, however, was limited to large-cap stocks, with most midcap and smallcap stocks closing higher. On the BSE, the midcap index closed a marginal 0.2% higher, but the smallcap index was up 1%. As a result, the advance-decline ratio on the BSE was in favour of the gainers. Compared to 1,455 stocks that ended in the red, there were 2,514 that closed in the green zone.The scenario was completely reversed for sensex stocks. Of the 30 index constituents, 25 closed in the red. HDFC Bank, Infosys, and Reliance Industries contributed the most to the day’s loss in the index, BSE data showed. The day’s selling was led by foreign funds that recorded a net outflow of Rs 477 crore, end-of-the-session institutional trading data on the BSE showed. In contrast, domestic funds were strong buyers during the day.These funds recorded a net buying figure of Rs 4,274 crore.