Mumbai:

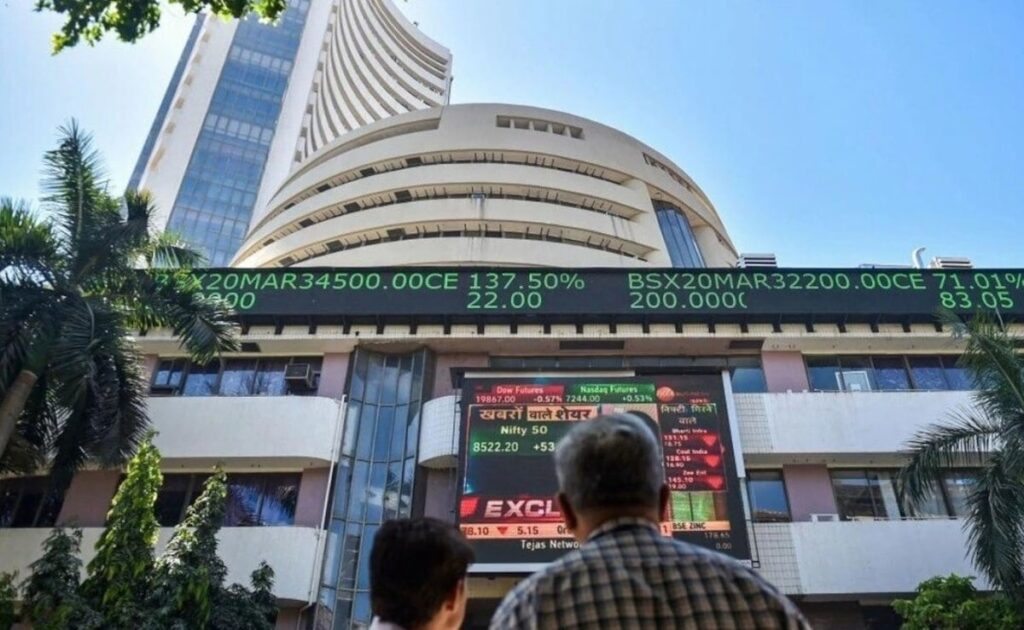

The Indian benchmark indices opened lower on Monday amid weak global cues, as selling was seen in the IT and financial service sectors in the early trade.

At around 9.34 am, Sensex was trading 541.66 points or 0.72 per cent down at 74,769.40 while the Nifty declined 158.40 points or 0.69 per cent at 22,637.50.

Nifty Bank was down 447.55 points or 0.91 per cent at 48,533.65. Nifty Midcap 100 index was trading at 49,699.45 after declining 786.75 points or 1.56 per cent. Nifty Smallcap 100 index was at 15,363.35 after dropping 273.55 points or 1.75 per cent.

According to experts, the market is facing headwinds from relentless foreign institutional investor (FII) selling and global uncertainties relating to US President Donald Trump’s trade tariffs.

After a negative opening, Nifty can find support at 22,700 followed by 22,600 and 22,500. On the higher side, 22,900 can be an immediate resistance, followed by 23,000 and 23,100, according to market watchers.

“The charts of Bank Nifty indicate that it may get support at 48,500 followed by 48,200 and 47,900. If the index advances further, 49,200 would be the initial key resistance, followed by 49,500 and 49,700,” said Hardik Matalia of Choice Broking.

Meanwhile, in the Sensex pack, Zomato, HCL Tech, PowerGrid, NTPC, IndusInd Bank, HDFC Bank, Tech Mahindra, TCS, SBI and Infosys were the top losers. Whereas, Nestle India, Bajaj Finserv, Sun Pharma and ITC were the top gainers.

In the last trading session on Friday, Dow Jones declined 1.69 per cent to close at 43,428.02. The S&P 500 declined 1.71 per cent to 6,013.13 and the Nasdaq declined 2.20 per cent to close at 19,524.01.

In the Asian markets, Seoul, China, Bangkok, Japan, Jakarta and Hong Kong were trading in red.

Gold and silver witnessed high volatility last week amid global uncertainty due to tariff fears. Gold prices gained for the eighth consecutive week in the international markets and are trading at record highs, said experts.

“The dollar index saw profit taking at their highs amid downbeat US services PMI data as services PMI slipped below 50 levels for the first time since 25 months. The U.S. jobless claims also surged and pushed the dollar index lower,” said Rahul Kalantri, VP Commodities of Mehta Equities Ltd.

The FIIs remained net sellers for the third consecutive session on February 21 as they sold equities worth Rs 3,449.15 crore. However, domestic institutional investors (DIIs) remained net buyers on 13th day as they bought equities worth Rs 2,884.61 crore.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)