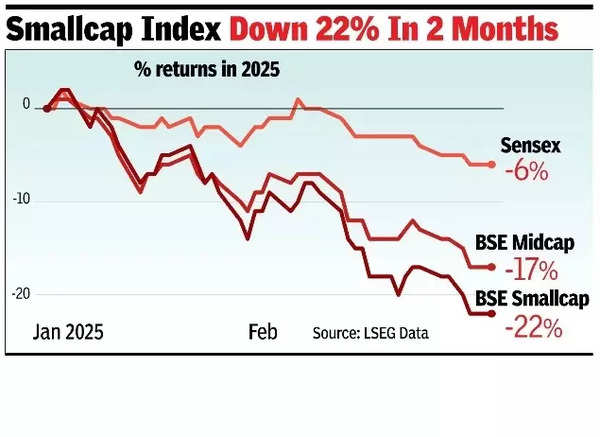

MUMBAI: Boring may be better for most Dalal Street investors. While the sensex is down over 6% this year, the BSE midcap index has slid 17% and smallcap has plunged over 22%.

Market players say that pain for mid and small-cap investors is not likely to ease soon – due to earnings downgrades and overvaluation concerns. At the same time, some institutional investors are beginning to see some value in large-cap stocks. However, any upside will be limited until the relentless selling by foreign funds eases.

To be sure, over a five-year period, the BSE midcap index is up 172%, while the smallcap one has rallied 220%, as against the sensex’s 95% gain. The sharp drawdown in small and mid-cap stocks isn’t particularly surprising as these scrips are typically more volatile than blue chips. Financial advisers say that small and mid-cap stocks should only be considered by long-term investors. “Domestic investors remain worried about the risk of further earnings downgrades given the weak commentary by many companies,” Pratik Gupta, CEO & co-head, Kotak Institutional Equities, said.

Analysts see the slowdown continuing to impact corporate earnings through the current quarter and the June quarter. Institutional investors – foreign and domestic – say there is scope for small and mid-cap stocks to fall further. “Even after the recent correction, we do not believe mid & small-cap valuations have come down enough,” Gupta said.

While NSE data shows that foreign funds ownership in Indian stocks has dropped to a 13-year low of 17.4% as of Dec, these investors continue to hold an oversized influence on the D-Street. Analysts expect the foreign fund selling to slow in March as large-cap valuations look ‘less expensive’.

“Foreign funds are unlikely to sell as aggressively as in the last few months. Long-term investors can utilise the weakness in the market to slowly accumulate fairly valued quality large-caps,” V K Vijayakumar, chief investment strategist, Geojit Financial Services, said in a note.