Mumbai:

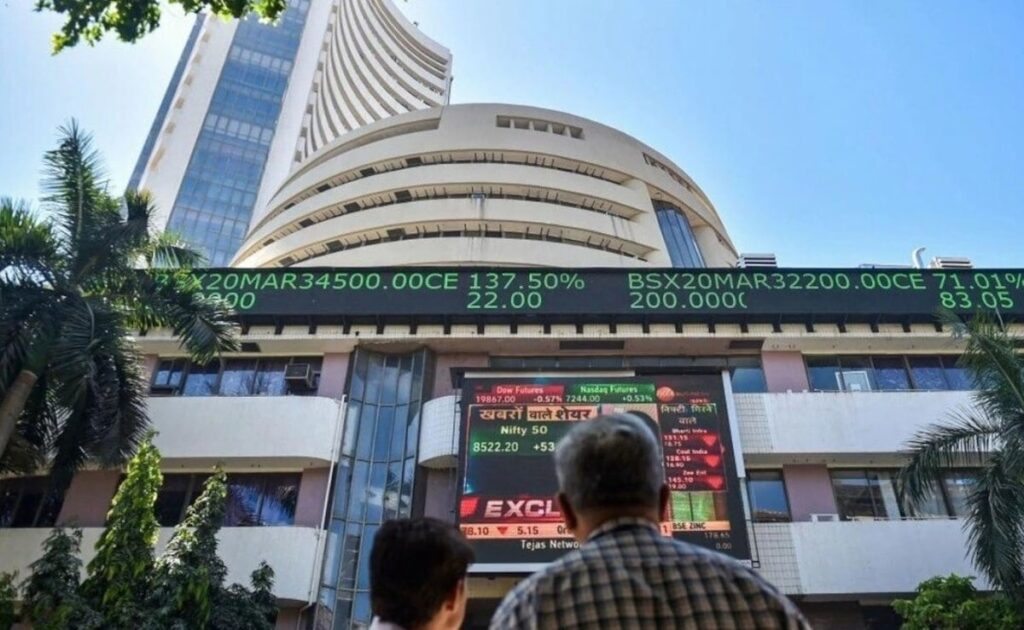

The Indian benchmark indices opened higher on Wednesday amid mixed global cues, as buying was seen in auto, IT and PSU Bank sectors in early trade.

At around 9.31 am, Sensex was trading 358.34 points or 0.49 per cent up at 73,348.27 while the Nifty added 106.40 points or 0.48 per cent at 22,189.05.

Nifty Bank was up 147.80 points or 0.31 per cent at 48,393. The Nifty Midcap 100 index was trading at 48,337.15 after adding 329.30 points or 0.69 per cent. Nifty Smallcap 100 index was at 14,909.40 after rising 146.80 points or 0.99 per cent.

According to experts, markets could see a subdued opening tracking overnight weakness in US markets, but optimism in other Asian indices may aid sentiment after benchmark Nifty ended in red for the 10th day in a row on Tuesday.

“The market is dealing with the pessimism of the likely impact of Trump’s reciprocating tariff policy amidst escalating trade tensions and growing signs of an economic slowdown and sticky US inflation,” said Prashanth Tapse, Sr VP Research Analyst at Mehta Equities.

“Technically, in case Nifty gives up 22,000 on a closing basis, then the next big support will come at 21,281 mark,” he added.

Given the ongoing volatility, traders are advised to exercise caution, implement strict stop-loss strategies, and avoid carrying overnight positions.

Meanwhile, in the Sensex pack, HCL Tech, M&M, PowerGrid, Tech Mahindra, Zomato, Tata Steel, Tata Motors and ICICI Bank were the top gainers. Whereas, Bajaj Finance, Bajaj Finserv, UltraTech Cement and HDFC Bank were the top losers.

In the last trading session, Dow Jones declined 1.55 per cent to close at 42,520.99. The S&P 500 declined 1.22 per cent to 5,778.15 and the Nasdaq declined 0.35 per cent to close at 18,285.16.

In the Asian markets, Bangkok, China, Japan, Seoul, Jakarta and Hong Kong were trading in green.

The foreign institutional investors (FIIs) extended their selling on March 4 as they sold equities worth Rs 3,405.82 crore. However, domestic institutional investors (DIIs) also extended their buying as they bought equities worth Rs 4,851.43 crore, on the same day.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)