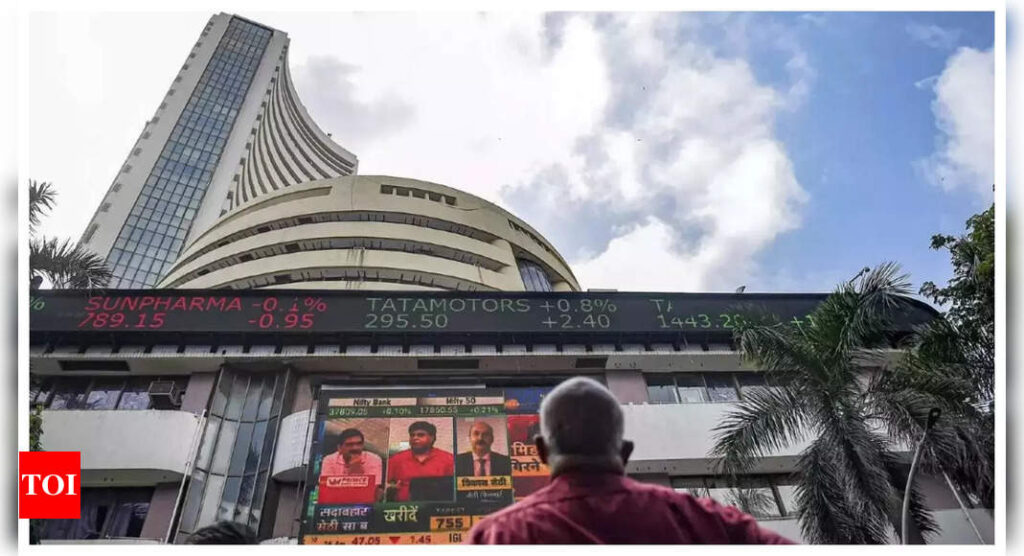

MUMBAI: Dovish comments from the US Fed chair on Wednesday night after keeping rates unchanged led to an 899-point rally in sensex on Thursday that took the index to close above the 76K mark, a one-month closing high. It was the fourth consecutive session of gains for the index during which it added a little over Rs 2,500 points or 3.4% to 76,348 points now, exchange data showed.

On the NSE, the nifty again ended above the 23K mark after about a month, at 23,191 points, up 283 points or 1.2%. “The (day’s) rally was driven by gains in the US market after the Federal Reserve maintained its forecast of two rate cuts this year despite the ongoing tariff concerns,” said Siddhartha Khemka of Motilal Oswal Financial Services. “(However), it lowered the economic growth forecasts and raised projections for inflation. It also highlighted the growing uncertainty over the impact of Trumps policies on the economy, resulting in mixed sentiments among investors.”

The day’s rally on Dalal Street added about Rs 3.6 lakh crore to investors’ wealth with BSE’s market capitalisation now at TRs 408.6 lakh crore.

The rally, for a change, was supported by strong buying by foreign funds while domestic funds were net sellers. BSE data showed foreign investors were net buyers at Rs 3,239 crore while domestic institutional investors (DIIs) were net sellers at Rs 3,136 crore. Since the start of the year, FPIs have been net sellers with the aggregate value at about Rs 1.5 lakh crore. On the other hand, the corresponding data for DIIs is Rs 1.85 lakh crore, data from NSDL and BSE showed.

“Consistent fall of the US dollar index has reduced the intensity of FII selling while DII buying continues to be strong, thus triggering the recent upside,” said Vinod Nair of Geojit Financial Services.