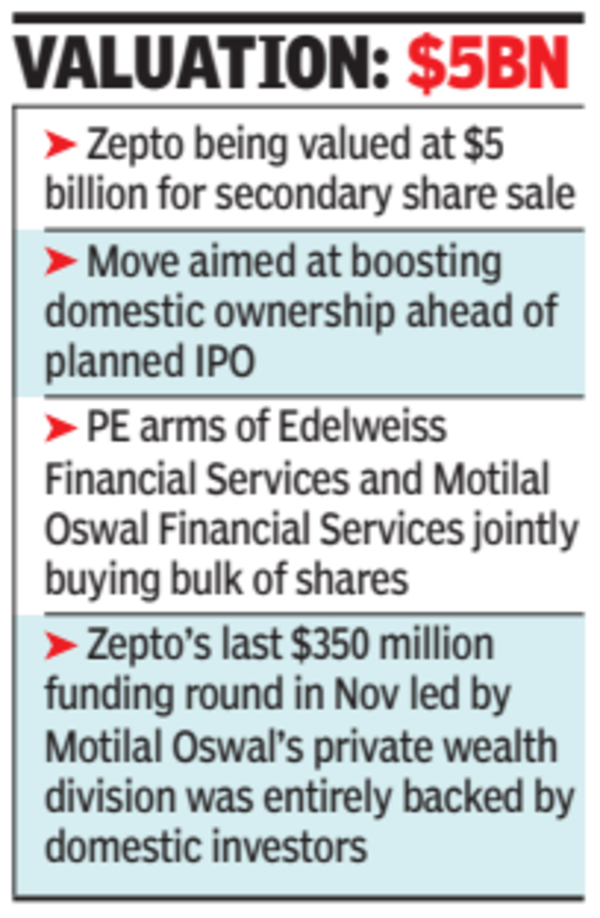

MUMBAI: Zepto is undertaking a secondary share sale worth over $200 million at the same valuation of $5 billion to boost domestic ownership ahead of its planned initial public offering (IPO), preparations for which have picked up pace with the company planning to file draft IPO papers in a month’s time, sources said.

As part of the secondary transaction, the private equity arms of Edelweiss Financial Services and Motilal Oswal Financial Services are jointly buying the bulk of the shares from some of the startup’s global investors. The idea is to increase domestic shareholding to at least 40% from the current 33%. “The company intends to eventually shore up domestic shareholding to 50%. Strong domestic ownership is favourable for the business as it prepares to go public,” a source told TOI. Zepto declined to comment.

The startup has been trying to raise participation of local investors. Zepto’s last $350 million funding round in November was led by Motilal Oswal’s private wealth division was entirely backed by domestic investors including a clutch of Indian family offices. The company which recently completed the process of shifting its domicile to India from Singapore is firming up its draft IPO papers in consultation with bankers, sources said. The IPO size and valuation are still being discussed but sources indicated that with Zepto already being valued at $5 billion and having shown growth in its annualised gross order value (GOV) which it claims touched $3 billion, the startup will seek a higher valuation, potentially looking at close to $10 billion.

Zepto rivals publicly listed Zomato (now Eternal Ltd) and Swiggy in the quick commerce sector and is also competing with them in the rapid food delivery space by launching a separate app for its food service Zepto Café.

Investor appetite for the instant delivery space has surged amid increasing consumer adoption, particularly in metros, with Zepto alone bagging $1.3billion in funding from investors last year.