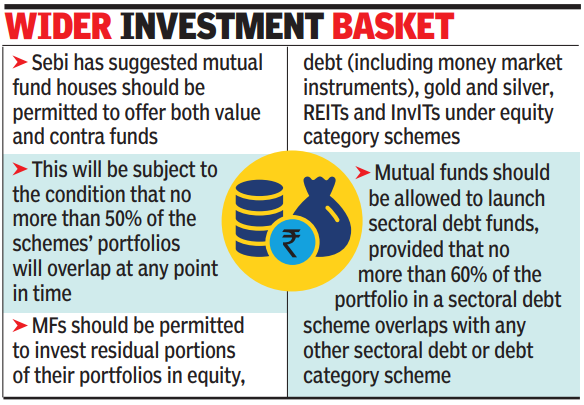

MUMBAI: Markets regulator Sebi on Friday floated a consultation paper for changes to the scheme categorisation process, financial instruments into which each fund would be allowed to invest in, and if fund houses should be allowed to launch solution-oriented schemes.Sebi is also mulling allowing fund houses to launch sectoral debt funds, on the lines of sectoral equity funds.If the proposals are accepted, most of the schemes will be allowed to invest some part of their corpus in REITs and InvITs. The nomenclature of MF schemes could also see some changes with tenure of funds, like 3-5 years, 7-10 years included in the scheme names, along with the current names like medium term fund, long term fund etc.

Wider investment basket

One of the proposals, according to Sebi, is to allow fund houses to offer solution-oriented life cycle fund of funds (FoFs), with a lock in, for specific goals such as retirement, housing, marriage etc. A solution oriented open-ended FoF with a target date, could have various structures, the Sebi paper said.For example, a Retirement Life Cycle FoF with the target maturity in 2055 (that is a tenure of 30 years) will remain invested in equity funds for the first 24 years, then shift the same in hybrid funds for the next three years. During the last three years of its tenure, its investments will be in debt funds.Sebi is also asking the public if such solutions-oriented life cycle FoFs should have different lock-in periods such as three years, five years, 10 years etc. “However, the said lock-in period would not be applicable to any existing investment by an investor, registered SIPs and incoming STPs in the existing solution-oriented schemes as on the date on which such scheme is getting realigned with these provisions,” Sebi said.According to Sebi, if its proposals are approved, investment objectives, investment strategies and benchmark of each scheme will be suitably modified to bring them in line with the categories of schemes.The regulator would also allow fund houses to launch an additional scheme in the existing scheme categories, provided those fund houses meet certain conditions.