MUMBAI: SBI attributed a slowdown in loan growth to companies using equity issue proceeds to repay debt and deleverage. The country’s largest bank projected credit growth of 14-16% for FY25 in Q2 but moderated its guidance in the next quarter to the lower end of that range.However, by the end of FY25, the bank’s total advances rose 12% to cross Rs 42 lakh crore. Growth was weighed down by the corporate segment.

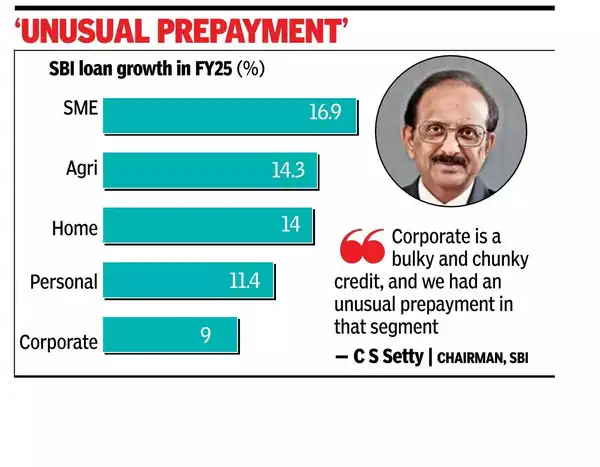

Loans to small & medium enterprises rose 16.9% to over Rs 5 lakh crore, while agriculture loans grew 14.3%. Retail personal loans and corporate loans rose 11.4% and 9%, respectively. Home loans, which grew 14%, were the key driver of retail credit.

Bank officials said many large central PSUs used equity funding to pare debt, leading to prepayments that couldn’t be compensated within a quarter. “We still have visibility in corporate credit. While we are not expecting 14-16% growth, 12-13% is quite possible as the industry is growing below 12%,” an official said. In FY25, NTPC raised Rs 10,000 crore through an IPO.

“Corporate is a bulky and chunky credit, and we had an unusual prepayment in that segment,” SBI chairman C S Setty said during an analyst call. “While we have a Rs 3.4-lakh-crore pipeline in corporate loans, unanticipated prepayments impacted growth.” The bank said credit demand was coming from infrastructure, renewable energy, data centres, and commercial realty.

The official added the bank had Rs 1.7 lakh crore in sanctioned but undisbursed corporate loans. “We hope there are no further prepayments. Broadly, we are sticking to a 12% growth target in the corporate book,” the official said.

On Saturday, SBI reported an 8.3% drop in consolidated net profit to Rs 19,600 crore for the March quarter from Rs 21,384 crore a year earlier, as net interest margins declined. Standalone profit fell to Rs 18,642 crore from Rs 20,698 crore.