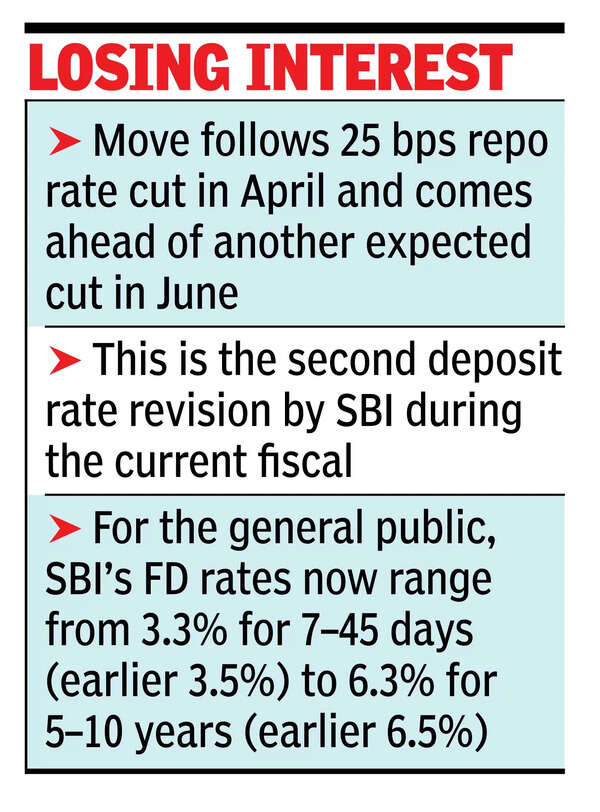

MUMBAI: State Bank of India has cut fixed deposit rates by 20 basis points across all tenors for both the general public and senior citizens from May 16. The move follows a 25 bps repo rate cut by RBI in April and comes ahead of another expected cut in June.RBI also infused nearly Rs 5 lakh crore of liquidity into the system, lowering funding costs. HDFC Bank already reduced rates, and SBI’s move is expected to prompt more lenders to follow.This is the second deposit rate revision by SBI during the current fiscal. The country’s largest bank cut its deposit (fixed deposit) rates first on April 15 by up to 25 basis points.

For the general public, SBI’s FD rates now range from 3.3% for 7-45 days (earlier 3.5%) to 6.3% for 5-10 years (earlier 6.5%). Senior citizen rates similarly dropped, with the highest now at 7.3% for 5-10 years, including the SBI We-care premium (earlier 7.5%). In the Rs 1.01 cr-Rs 3 cr non-callable category, 1- and 2-year FDs now offer 6.8% and 7.1% for the public, and 7.3% and 7.6% for senior citizens. The Amrit Vrishti (444-day) scheme rate was cut from 7.05% to 6.85%. Super senior citizens continue to get 10 bps over the senior rate. Revised rates exclude products like recurring deposits, MODS, and Green Rupee Term Deposits.SBI’s home loan rates already came down in line with the repo rate reduction. Now, with the reduction in deposit rates, loans to businesses are expected to get cheaper as these are linked to the marginal cost of lending rate.