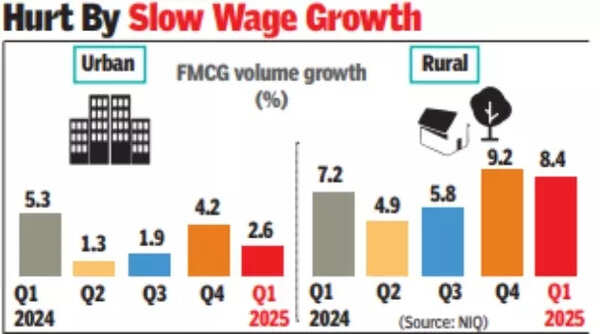

MUMBAI: Urban consumption, which has been under pressure on the back of high inflation that pushed consumers to cut back on spending, “decelerated” further in the March quarter, weighing on the volume growth of companies, NielsenIQ said in its quarterly FMCG snapshot on Thursday.Rural demand boosted spending on lotions, shampoos, and detergents, even as high edible oil prices slowed demand for staples.“In Q1 2025, rural consumer demand grew at a slower pace compared to Q1 2024, yet it remained four times faster than growth in urban areas, where consumption further decelerated,” analysts at NIQ said. Rural volumes grew at 8.4% during the quarter, while urban lagged at 2.6%. Urban volume growth stood at 4.2% in the preceding quarter and 5.3% a year ago.The slowdown in urban volumes in the top eight metros was partly due to the growing shift to e-commerce. NIQ doesn’t combine the online and offline retail sales data while capturing total volumes.

sow wage growth

The FMCG sector recorded a value growth of 11% in the March quarter compared to 6.5% growth in the year-ago period, helped by a 5.6% increase in prices. Volume growth (overall) stood at 5.1% during the quarter, lower than the 6.1% growth posted a year ago. The industry saw a unit growth of 6% in the quarter, indicating a consumption shift to smaller packs. Price hikes taken by companies due to rising commodity costs nudged shoppers to move to smaller packs and, in some cases, regional brands.Unit growth refers to the number of individual units sold, while volume growth is the total quantity of goods sold.Slow wage growth, which failed to keep pace with high inflation, and a weak job market are among the factors that have hit the urban middle class, company executives indicated in recent earnings calls.