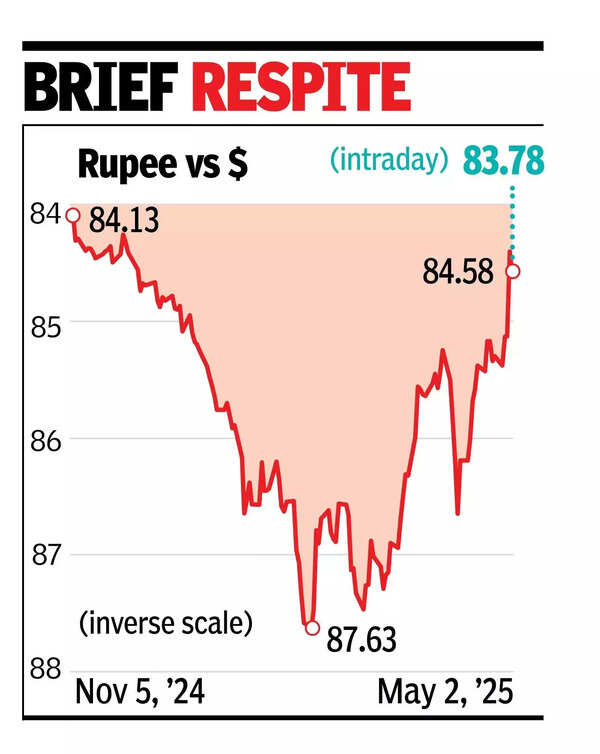

MUMBAI: The rupee briefly touched a six-month high on Friday, climbing to 83.78 against the dollar in early trade, before retreating following probably RBI intervention.

The domestic currency closed at 84.58, 9 paise weaker than its previous close of 84.49. Traders attributed the initial strength to strong portfolio inflows and the unwinding of bearish rupee bets, but said dollar-buying by state-run banks, likely on behalf of RBI, eroded gains.According to dealers, RBI may be aiming to prevent the rupee from appreciating too sharply against theChinese yuan, as a stronger rupee could undermine export competitiveness and widen the current account deficit.

The rupee appreciated nearly 1% during the week, buoyed by inflows into Indian equities and optimism surrounding a potential US-India trade deal. It has risen over 3% in the past two months, recovering most losses incurred after the US elections.

Meanwhile, forex reserves increased for the eighth consecutive week, reaching $688.13 billion as of April 25. This is the highest level in over six months, though still about $17 billion below the Sept 2023 record of $704.9 billion. Reserves rose by $2 billion during the week, and by $47.5 billion cumulatively over the previous seven weeks. These changes reflect both RBI’s intervention in the forex market and valuation shifts in foreign assets.During the latest reserve data week, the rupee depreciated 0.1% on a weekly basis, which traders attributed to geopolitical tensions withPakistan.

The dollar fell on Friday ahead of jobs data but remained on track for a third straight weekly gain, supported by earlier gains in Treasuries and equities. The yen rose 0.5%, the euro 0.4%, and China’s offshore yuan hit a near six-month high. The Australian and New Zealand dollars also strengthened on positive equity moves tied to tariff talks involving China and Japan.

Dealers said that the dollar came under pressure as hopes of a rate cut in the US are dimming because of tariff-fuelled inflation fears. Historically, hardening of US yields have resulted in global funds moving into US securities resulting in a sharp gain in the dollar. However, this time global funds are wary and the dollar index had fallen to 99.9.