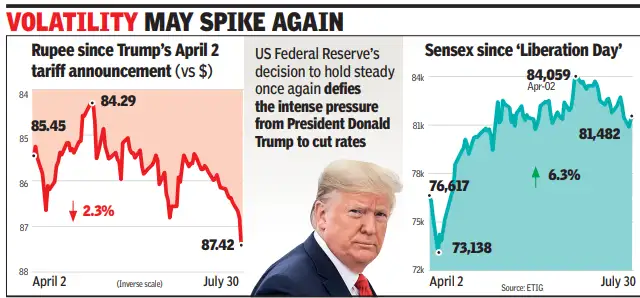

MUMBAI: Equity and forex markets may see heightened volatility on Thursday after US President Donald Trump doubled down on tariff announcements for Indian imports. The rupee, which posted its steepest one-day drop since May, closed at a five-month low of 87.42 on Wednesday, down 0.7% after ending Tuesday at 86.82. Traders cited strong dollar demand and concerns over steep US tariffs on Indian goods.“Despite the unpredictable policymaking of US, market was expecting a tariff deal to work out as longer-term US-India strategic interests are aligned. Markets will hope for a ‘TACO’ (Trump always chickens out) trade if better senses prevail,” said Nilesh Shah, MD, Kotak Mahindra AMC.

“Both rupee and equity markets are weakening together after nearly six years. The rupee is likely to breach 88/$ level this week,” said K N Dey, a corporate forex consultant.