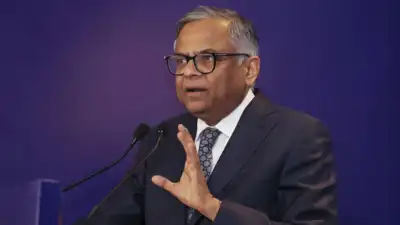

MUMBAI: N Chandrasekaran, who heads Tata Sons, the principal entity of the $180-billion Tata Group, saw his compensation increase to Rs 156 crore in FY25. It makes him one of the highest-paid professional chieftains in India Inc, who earn more than Rs 150 crore annually. His earnings increased by 15% from the Rs 135 crore he received in FY24. Since taking on the role of Tata Sons chairman in Feb 2017, Chandrasekaran’s remuneration has seen significant growth, especially when compared to his initial compensation of Rs 55 crore in FY18. CMS Info Systems’ vice-chairman Rajiv Kaul earned Rs 181 crore in FY24, Persistent Systems’ CEO Sandeep Kalra took home Rs 148 crore in FY25. There are a few executives in the Rs 100-crore remuneration club, including Bajaj Finance’s Rajeev Jain, who took home Rs 102 crore in FY25.Meanwhile, Tata Group’s semiconductor manufacturing business has emerged as a significant revenue generator within just five years of its inception, ranking as the sixth-largest contributor despite challenges.Tata Electronics, which began operations in 2020, recorded Rs 66,601 crore revenue in FY25, with a modest deficit of Rs 70 crore. The relatively small loss indicates potential profitability in the near future. The company’s growth trajectory includes strategic acquisitions, comprising the Rs 1,078 crore purchase of Wistron India in 2024, and a Rs 1,650 crore investment for a 60% stake in Pegatron India. In the capital-intensive world of technology hardware, I am told this is a good start.” Tata Sons invested Rs 3,000 crore in Tata Electronics in FY25, the holdco’s FY25 report showed. The aviation business, a recent addition to the Tata Group’s portfolio, generated Rs 78,636 crore in revenue, ranking fourth in revenue contribution, after Tata Steel (Rs 2.2 lakh crore), TCS (Rs 2.6 lakh crore) and Tata Motors (Rs 4.5 lakh). However, Air India emerged as the conglomerate’s biggest loss-making entity in FY25. In FY25, Air India, which was acquired by Tata Sons in 2022, received an investment of Rs 3,225 crore from the parent. Tata Digital, which runs the Tata Neu super app, registered the second-highest loss, amounting to Rs 4,610 crore. In FY25, Tata Sons infused Rs 3,960 crore in Tata Digital. The biggest profit contributors to the nearly 160-year-old Tata Group was TCS (Rs 48,797 crore).