MUMBAI: Iran’s parliamentary move to approve the closure of the Strait of Hormuz, an oil shipping chokepoint, has jolted global insurance markets. Already uneasy over the Red Sea disruptions, marine insurers are now bracing for a spike in war risk premiums and the possible withdrawal of war cover across the Persian Gulf.“The ongoing Iran-Israel-US conflict has heightened tensions in the Persian Gulf, a region already classified as a high-risk area in marine insurance,” said Gaurav Agarwal, VP at Prudent Insurance Brokers.“Insurers have been charging additional war premiums for many years. With the recent escalation, including the US involvement and Iran’s parliamentary approval to block the Strait of Hormuz, insurers are on high alert. We anticipate potential increase in war premiums for cargo shipments in the region. In extreme cases, insurers might withdraw war cover altogether, similar to the Black Sea area due to the Russia-Ukraine conflict. The insurers continue monitoring the situation and adjust our strategies accordingly,” he said.

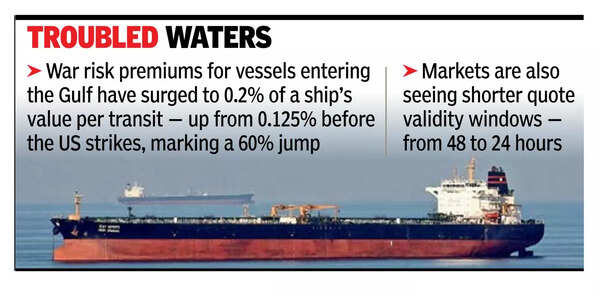

Marine underwriters are treating the Persian Gulf with renewed caution. According to a senior official at a state-run insurer, war risk premiums for vessels entering the Gulf have surged to 0.2% of a ship’s value per transit – up from 0.125% before the latest strikes, marking a 60% jump. Premiums for Israeli port calls have more than tripled to 0.7% from 0.2%, while rates for Red Sea transits have also edged up to 0.25-0.3%.“The conventional war risk cover was already suspended for cargo travelling through the Red Sea,” said Bhavesh Patel, executive director at Edme Insurance Brokers. He added, “The conflict could have implications for insurance covers on airlines that may be called for evacuation.”Markets are also seeing shorter quote validity windows – from 48 to 24 hours – reflecting heightened volatility. Insurance for a typical ‘very large crude carrier’ carrying oil from Saudi Arabia to China has reportedly risen from $0.25 to $0.7-0.8 per barrel overnight.Some underwriters in the global markets are rolling out “blocking and trapping” cover, aimed at vessels that could be immobilised in the event of a closure. Others are demanding proof of risk mitigation – requiring ships to avoid conflict zones – as a precondition for coverage. War risk premiums in the Gulf are projected to rise to 0.2-0.4% of insured value, with further hikes expected if tensions persist.