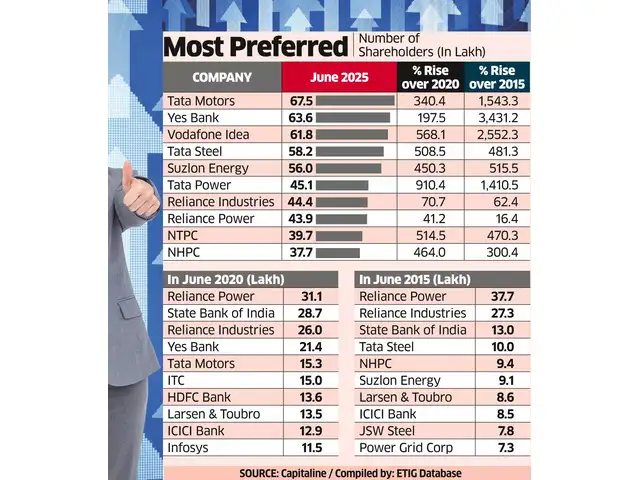

Tata Motors, Yes Bank, and Vodafone Idea have emerged as India’s most widely held stocks, surpassing earlier favourites like Reliance Power, Reliance Industries, and State Bank of India, amid a surge in retail investor participation.According to data compiled by ETIG, Tata Motors topped the list with over 67.5 lakh shareholders as of June 2025 — nearly 3.4 times its count in June 2020 and 15 times more than in 2015, when the stock had just 4.1 lakh shareholders, according to an ET report.Yes Bank followed with 63.5 lakh shareholders, almost double its 2020 base and 3.5 times higher than in 2015. Vodafone Idea’s shareholder base also expanded sharply to 61.8 lakh, up 6.5 times from 2020 and 27 times from 2015, when it had just 2.3 lakh shareholders.The increase in shareholder count reflects rising direct participation in Indian equity markets over the last five years. Investors are drawn to a mix of momentum plays, low-priced stocks, and potential turnaround stories.“Investors are buying not for what these companies are today, but for what they could become if their turnaround or transformation stories play out successfully,” said Prashant Tapse, senior vice president – research at Mehta Equities Ltd.

Tata Steel also saw a sharp rise, with its shareholder count rising more than six-fold over five years to reach 58.2 lakh in June 2025. Other companies with notable gains include Tata Power, NTPC, NHPC, and Reliance Industries.In 2020, Reliance Power led the shareholder charts with 37.7 lakh holders, followed by Reliance Industries (27.3 lakh), SBI (13 lakh) and Tata Steel (10 lakh). Even as many of these names remain popular, their ranks have shifted significantly by 2025.Back in 2015, Reliance Power had the highest retail base, followed by Reliance Industries, Tata Motors (4.1 lakh) and Yes Bank (1.8 lakh).A large shareholder base doesn’t necessarily reflect a company’s intrinsic value, and seasoned investors often avoid such widely held stocks during market peaks. According to analysts, these shares typically trade at elevated valuations, leaving little margin of safety and skewing the risk-reward balance unfavourably