NEW DELHI: Retail inflation cooled to a seven-month low in Feb as food prices eased, providing headroom for the Reserve Bank of India (RBI) to lower interest rates in April, while industrial output growth improved in Jan, led by expansion in manufacturing.

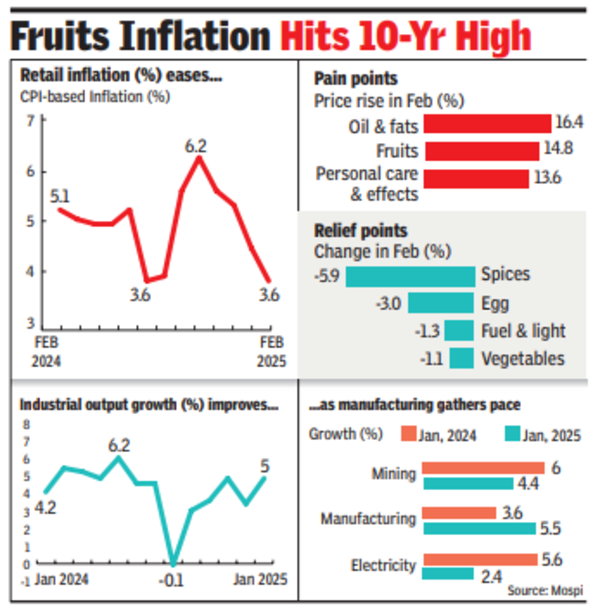

Data released by the National Statistical Office (NSO) on Wednesday showed inflation, as measured by the consumer price index (CPI), rose an annual 3.6% in Feb, slower than the 4.3% in Jan and below the 5.1% recorded in Feb last year. There is a decline of 65 basis points in headline inflation in Feb compared to Jan and it is the lowest year-on-year inflation after July. The Feb number is below 4% — the lower band of RBI’s tolerance level.

Fruits Inflation Hits 10-Yr High

The food price index slowed to 3.8% in Feb, lower than the nearly 6% in Jan and 8.7% in Feb 2024. Rural inflation cooled to 3.8% in Feb from 4.6% in Jan, while urban inflation also slowed to 3.3% during the month from 3.9% in Jan.

The inflation rate in vegetables, pulses and products, eggs and spices contracted in Feb. Inflation in oils and fats rose 16.4% — a 34-month high — during the month, while in fruits, it was at 14.8% — a 10-year high. Vegetables inflation has slid into the negative zone after 20 months and according to SBI Research among vegetables, the 80% of month-on-month decline is attributed to three vegetables only (garlic, potato, tomato).

Experts expect the central bank to cut rates further to help boost growth against the backdrop of easing price pressures. “The Feb CPI inflation print falling well below 4% has cemented the expectation of a back-to-back 25 basis points rate cut in the April 2025 MPC meeting. This may be followed by another 25 bps repo rate cut either in the June 2025 or the Aug 2025 meetings, dependent in large part on the next GDP growth print for Q4 FY2025,” said Aditi Nayar, chief economist at ratings agency Icra.

Separate data showed the index of industrial production (IIP) rose 5% in Jan, faster than the upwardly revised 3.5% in Dec. The manufacturing sector grew by 5.5% in Jan, higher than the 3.6% recorded in the same month last year and above the 3.4% in Dec.