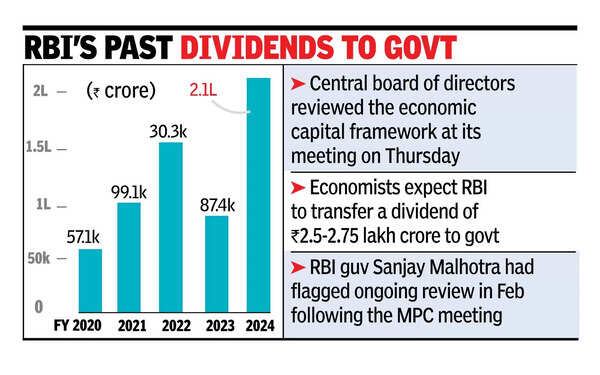

MUMBAI: The way RBI calculates the dividend it pays to govt may soon change, with the central board of directors reviewing the economic capital framework at its meeting here on Thursday. The meeting was chaired by governor Sanjay Malhotra and comes five years after the Bimal Jalan Committee’s recommendations, which form the basis of the current framework.Economists expect RBI to transfer a dividend of Rs 2.5-2.75 lakh crore to govt, owing to record profits from selling dollars from its reserves at high margins following the rupee’s depreciation in the second half of FY25. While these earnings were booked in FY25, the dividend will be paid out in the current fiscal. RBI typically transfers the dividend in the last week of May.The Jalan Committee’s 2019 report recommended including revaluation balances in RBI’s risk buffers but limiting their use to cover market risks, recognising their inherent volatility. It also proposed that the surplus distribution policy should factor in both total economic capital and realised equity to ensure a balance between overall capital and the more stable portion of reserves.

RBI’s past dividends to govt

A key recommendation was to maintain the realised equity — referred to as the contingent risk buffer — within a range of 5.5% to 6.5% of RBI’s balance sheet. This range plays a critical role in determining how much surplus the central bank retains and how much it can transfer to govt. The committee also called for a review of the framework every five years to ensure it remains relevant.Malhotra flagged the ongoing review in a Feb press conference following the monetary policy meeting. “The Bimal Jalan committee has given a 5.5%-6.5% ratio of the balance sheet to be maintained as a buffer for us. We are at 6.5% on March 31, 2024, that is the overall framework, is being reviewed and based on that if the committee feels that there is any change, it could be upward or downward. I am not suggesting that because of uncertainties, it needs to be increased.That is under process and based on that we will take a decision as per the recommendations of the committee which is reviewing this,” he said.At the same briefing, deputy governor M Rajeshwar Rao noted that the Jalan Committee’s recommendations were applicable for the period from 2019 to March 2024. “Internally, we are reviewing the whole thing and seeing whether any changes are warranted, etc. Then internally, we will take it up appropriately through the process and then if we need to engage with govt or the board, we will do it at a later point in time. But the internal review is on and is in the process,” he said.