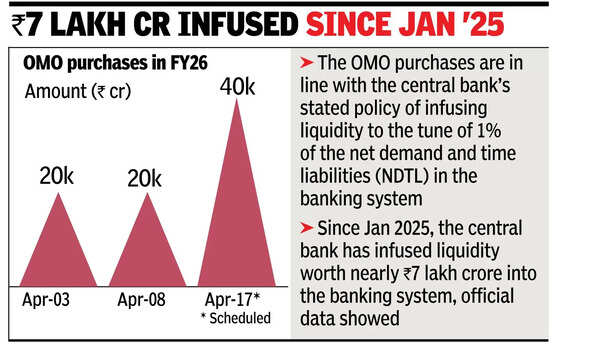

MUMBAI: The RBI on Friday said it will buy govt securities of various maturities aggregating Rs 40,000 crore on April 17. This will be the third open market operation (OMO) purchase of gilts by the central bank in the current fiscal. The first one of Rs 20,000 crore was conducted on April 3 while the second one, of the same amount, was on April 8.

The OMO purchases are in line with the central bank’s stated policy of infusing liquidity to the tune of 1% of the net demand and time liabilities (NDTL) in the banking system, a debt fund manager said. Currently, the NDTL of the banking system is about Rs 250 lakh crore. So, the expected liquidity infusion would be about Rs 2.5 lakh crore, fund managers said.

Since Jan 2025, the central bank has infused liquidity worth nearly Rs 7 lakh crore into the banking system, official data showed. Along with liquidity infusion, there were two rate cuts by the RBI, one each in Feb and April. The combined effect has been about 20-25 basis points fall in benchmark yield on 10-year gilts to around 6.5% level now. This, in turn, has also brought down interest rates on loans by banks and NBFCs. Lately, the central bank has changed the way it would measure liquidity in the banking system. It said that from now on it would consider system liquidity for infusing funds into the banking system, rather than durable liquidity which was the benchmark earlier.

The latter, in addition to liquidity in the banking system, also takes into account the cash balance with the govt which could be spent any time, thus infusing liquidity into the banking system. In contrast, system liquidity considers only the funds available in the banking system, and thus is usually equal or less than durable liquidity.