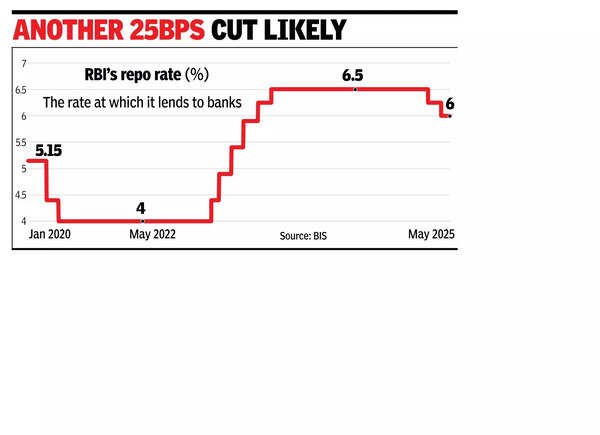

Mumbai: RBI is expected to cut the its benchmark rate by 25 basis points for the third successive time and continue with its supportive liquidity stance when the monetary policy committee concludes its three-day meeting on June 6. Economists say slowing growth and contained inflation leave room for further easing in monetary policy.India’s GDP growth slowed to 6.5% in FY25 from 9.2% the previous year, though the March quarter saw a better-than-expected print of 7.4%. Inflation, meanwhile, remains within the RBI’s 4% target. In April, RBI reduced its repo rate – the rate at which it lends to banks – by 25bps (100bps = 1 percentage point) to 6%.“We do believe that given the rather benign inflation conditions and the liquidity situation which has been made very comfortable through various measures of RBI, the MPC would go in for a 25bps cut in the repo rate on June 6,” said Madan Sabnavis, chief economist, Bank of Baroda. He added that the central bank is also expected to revise its forecasts for growth and inflation and offer an assessment of global risks, particularly the impact of the upcoming expiry of the US tariff reprieve in July.

A Prasanna of ICICI Securities also expects a 25bps cut, saying the robust Jan-March GDP growth confirms the case for moderate easing. “A preference for cuts in 25bps clips and accommodative stance means the MPC is well positioned to react to any data surprises on either side,” he said.He noted that RBI has already eased financial conditions by ensuring abundant liquidity. RBI has done this by pumping in rupee liquidity and by avoiding the usual borrowing that it does from money market to absorb surplus funds from banks.Barclays economist Aastha Gudwani noted that Q1 growth beat expectations, with GDP (gross domestic product) and GVA (gross value added) driven by a pickup in manufacturing and robust capital expenditure, even as consumption remained weak. “Full-year growth has come in at 6.5%,” she said.Crisil expects RBI to cut rates by another 50bps this fiscal, citing favourable macroeconomic tailwinds such as expectations of an above-normal monsoon and subdued global crude prices. The IMD forecast of 106% of the long period average for the monsoon is likely to support kharif output, boost rural demand, and keep food inflation in check. Crude prices are forecast to average $65-70 per barrel this fiscal, lower than last year’s $78.8.