MUMBAI: RBI has mooted a unique, secure borrower identifier to avoid duplication and misreporting of data with credit bureaus, and to improve loan access for borrowers.“Credit information companies rely on credit institutions to provide accurate and validated IDs. Without this, duplication and misreporting remain risks. We must move towards a unique borrower identifier, which is secure, verifiable, and consistent across the system,” RBI deputy governor M Rajeshwar Rao said in his keynote address at the 25th anniversary of TransUnion Cibil. He stressed the importance of better data practices for empowering borrowers.

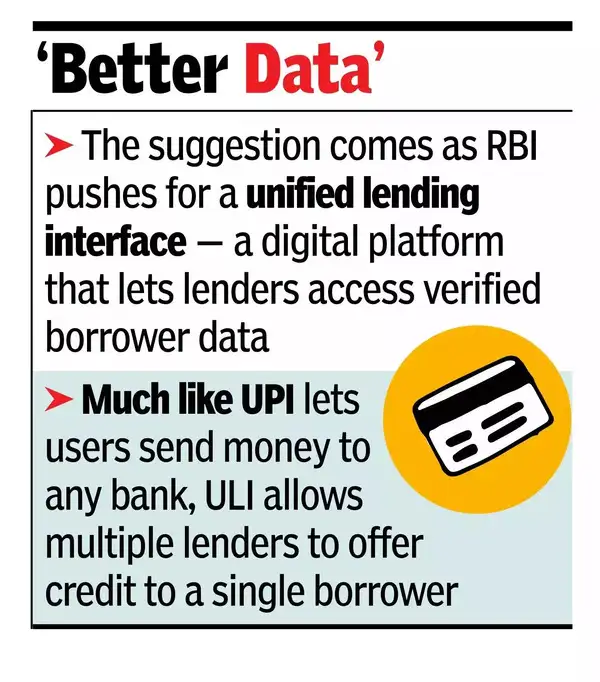

The suggestion comes as RBI pushes for a unified lending interface – a digital platform that lets lenders access verified borrower data. Much like UPI lets users send money to any bank, ULI allows multiple lenders to offer credit to a single borrower.Rao said that RBI is testing use of programmable digital rupees (CBDC) to give loans with restricted acceptance of the digital currency. This would start with a pilot for tenant farmers under the kisan credit card scheme. If successful, this could help extend collateral-free loans to small businesses, street vendors, and artisans, while creating digital records that make future lending easier.The deputy governor said that RBI has taken several policy measures taken to reduce information asymmetry, enhance data quality and improve customer satisfaction. These included free access to full credit reports, appointment of internal ombudsmen, and redressal frameworks linked to delayed corrections. With the introduction of the Data Quality Index and mandatory disclosures on wilful defaulters, he said, CICs are now more transparent and accountable.Rao also drew attention to the rapid expansion of digital infrastructure in credit delivery. “The convergence of Jan Dhan accounts, Aadhaar and mobile phones, popularly known as the JAM trinity, UPI and ULI, represents a significant advancement in India’s digital lending infrastructure,” he said.Rao noted the potential of alternative data, AI and machine learning in expanding access to underserved borrowers. “It seems that time is not far when alternative data will no longer be alternate, but it will be the mainstream,” he remarked. Similarly, the proposed Grameen Credit Score aims to help SHG members and rural borrowers enter the formal financial system.Despite this progress, he struck a note of caution: “We must remain cognizant of the need for addressing issues around data accuracy, data security, and model risk.” Responsible innovation, he said, must uphold the core values of integrity, transparency and public service.