MUMBAI: Economists expect RBI to cut interest rates by 25 basis points (100bps = 1 percentage point) at the conclusion of its three-day monetary policy meeting on April 9, despite global trade uncertainties triggered by US President Donald Trump’s tariffs. Inflation falling below RBI’s projections, along with signs of easing growth, has created room for further monetary easing.

Several economists also feel that RBI could signal a shift in policy stance. “Since the last meeting, inflation has come under control, which gives RBI more room to adopt for ‘less restrictive’ monetary policy and also support growth,” said Sonal Badhan, economist at Bank of Baroda.

She expects a 25bps rate cut and a change in stance to “accommodative,” with a cumulative 75bps reduction likely in this cycle. Another source of comfort to the rate setting panel is the sharp drop in crude oil prices globally coupled with a decline in the dollar index with some like Barclays seeing the possibility of a 35bps cut.

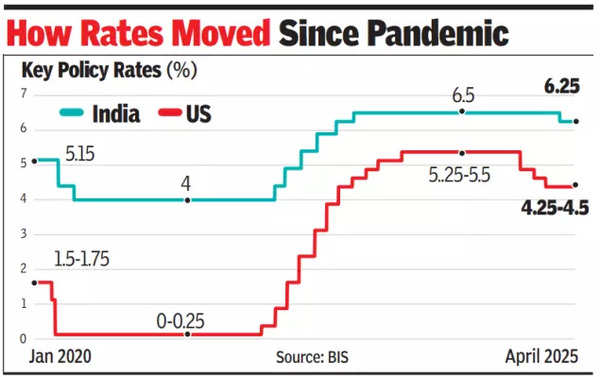

Radhika Rao of DBS Bank also expects the repo rate to be cut by 25bps to 6%. “Domestic data has aligned to make way for the monetary policy committee to lower rates further, characterised by easing inflation and growth while depreciation pressure on the rupee has eased significantly,” she said.

Rao added that trimmed inflation indicators remained benign, and more than two-thirds of CPI sub-components rose by less than 4% year-on-year in early 2025. She cautioned, however, that external risks persist. “The MPC is likely to be guarded on the uncertain global backdrop as trade distortions pose stagflationary risks to the US and raise the risk of slower global trade,” Rao said.

Barclays’ India chief economist Aastha Gudwani projects a 25bps cut as the base case but flagged the possibility of a 35bps easing to reflect the extent of undershooting on CPI inflation. “At 3.6% year-on-year, CPI inflation for Feb came in even lower than our below-consensus estimate,” she said. Gudwani also expects a neutral stance to be retained, arguing that while “a non-standard cut could suggest panic on growth, we advise against this perception”. Barclays sees inflation easing to 4% in FY26 and expects the terminal policy rate at 5.5% by Dec 2025.