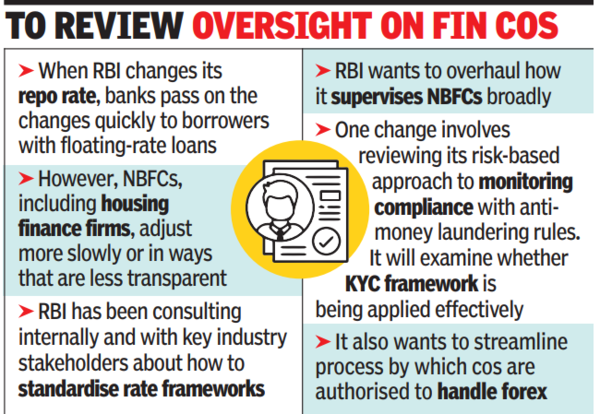

MUMBAI: RBI is looking to introduce interest rate rules for non-banking finance companies similar to those that govern banks. The goal is to improve how changes in monetary policy pass through to borrowers and to make loan pricing more transparent.As of now, when RBI changes its benchmark repo rate, banks pass on the changes quickly to borrowers with floating-rate loans. However, NBFCs, including housing finance firms, adjust more slowly or in ways that are less transparent. “The extant regulations on interest rates on advances vary across all regulated entities,” said RBI. “In order to harmonise the same, a comprehensive review of the extant regulatory instructions is underway.“RBI has been consulting internally and with key industry stakeholders about how to standardise interest rate frameworks. “In order to solicit wider public feedback, it is proposed to issue a discussion paper delineating the various imperatives of moving to a harmonised regime for interest rates on loans and advances across all regulated entities,” the central bank said in its annual report.

Analysts say the current system creates gaps in oversight. “Banks have repo rate-linked loans, MCLR (marginal cost of lending rate) loans, etc, which are all well defined and RBI can track how transmission happens,” said Suresh Ganapathy of Macquarie. “NBFCs don’t have these repo-linked or MCLR loans and they price their loans off some antiquated PLR (prime lending rate) concept. Of course, eventual end-pricing will be determined by competitive forces. Having said that, this entire process is super opaque and hence it is essential a proper alignment is sought,” Ganapathy added.RBI also wants to overhaul how it supervises NBFCs broadly. One change involves reviewing its risk-based approach to monitoring compliance with anti-money laundering rules. It will examine whether KYC framework is being applied effectively, especially for higher-risk firms.The regulator also plans a thematic review to ensure NBFCs follow interest rate guidelines, particularly to prevent customers from being charged excessive rates. At the same time, it is studying how to bring more NBFCs under a risk-based supervision model, where regulatory attention depends on the complexity and risk profile of each firm. RBI also plans to simplify rules for borrowing and lending in rupees, and to streamline the process by which companies are authorised to handle foreign currency under India’s foreign exchange law.