Savings a/c slowdown: PSBs may scrap min balance finesMUMBAI: Public sector banks are reconsidering the need for customers to maintain minimum balances in savings accounts, following discussions with the finance ministry over the declining share of current and savings accounts in total deposits.Canara Bank, Bank of Baroda, Punjab National Bank and Indian Bank have recently dropped this requirement, which means that customers who fail to maintain the minimum prescribed balance will not have to pay a penalty.

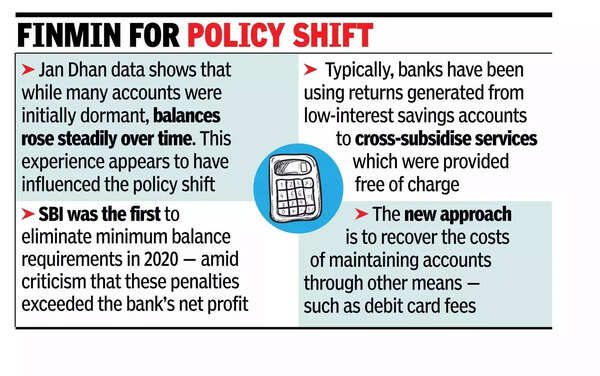

In a recent meeting, finance ministry officials are understood to have questioned banks on the need to penalise customers who do not maintain minimum balance. The concern stemmed from the slowdown in low-cost current and savings account deposits. RBI in its financial stability report noted that “banks’ liability profile is changing with the share of higher-cost term deposits and CDs growing compared to low-cost current account and savings account (Casa) deposits”According to bankers, Jan Dhan data suggests that while many of these accounts were initially dormant, balances rose steadily. This experience appears to have influenced the policy shift.SBI was the first to eliminate minimum balance requirements in 2020. The move followed public criticism after an RTI revealed that penalties collected for non-maintenance of balances exceeded the bank’s net profit, which had been offset by provisions for bad loans.Traditionally, public sector banks had lower balance requirements compared to private banks with the requirement waived for Jan Dhan accounts. Besides the mandatory exclusion of Jan Dhan accounts, private banks also waive minimum balance requirements on salary accounts and on those accounts where the customers maintain a threshold in terms of ‘relationship value’ which includes fixed deposits and other investments.Historically, banks have been using returns generated from low-interest savings accounts to cross-subsidise banking services which were provided free of charge. However, incremental costs for banks have reduced as most banking services are now provided through digital channels.The new approach is to recover the costs of maintaining accounts through other means – such as debit card fees and charges for transactions beyond free limits.